Buying new furniture, appliances, or a mattress can be...

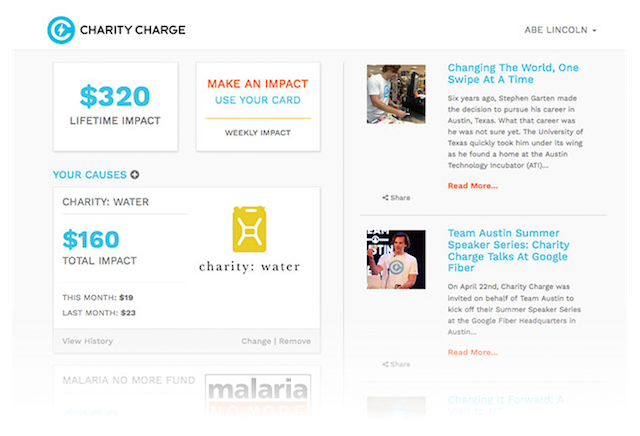

A Rewards Credit Card That Makes It Easy to Support Causes You Care About

Many people are intrigued by credit card rewards programs. Whether you want to earn cash back, miles in an airline’s frequent flyer program, or points in a hotel’s program, there are hundreds of cards available. Stephen Garten wanted a rewards credit card that lets you easily donate your cash back to charities. Some cards do this by allowing you to donate points or miles, or letting you offset a donation with a statement credit.

But Garten had a different idea. He wanted every swipe to lead to a donation and an altruistic company to back the product. In 2016, he founded Charity Charge and started offering consumers the Charity Charge credit card. Using it, you can earn 1 percent cash back on eligible purchases and all your earnings will be donated to nonprofit(s) of your choice.

Louis DeNicola: What is Charity Charge?

Louis DeNicola: What is Charity Charge?

Stephen Garten: Charity Charge is a public-benefit corporation that was created to give people an easy way to give back to the nonprofits and causes that they care about. On a product level, Charity Charge is a MasterCard credit card that lets the cardholder earn 1 percent cash back as a tax deductible donation to any nonprofit of their choice.

There are over one and a half million nonprofits you can support, including K-12 schools. Every time a cardholder makes a purchase, that cash back goes to the nonprofit they chose to support.

Something that's pretty unique in this space is that you can also support multiple nonprofits and your donations are tax deductible.

We also underwrite the donation processing fees, so 100 percent of what you earn reaches your nonprofits.

Traditionally, if you were to use a credit card to make a donation directly, say on a nonprofit’s website, two to three percent of that would get eaten up in credit card processing fees. In this case, nothing gets eaten up from the cash back that you earn.

What inspired you to start Charity Charge?

Two main things inspired me. One kind of on the macro level and then another on the micro.

I'd say on the macro, unfortunately, when I was 19 in college, my father passed away. He had cancer. He was 53 and a huge role model for me and someone that I obviously really loved and looked up to.

Growing up, I saw how altruistic he was and how he helped others. When he passed away, it really hit me that he was so young. I was in college, figuring out my major, and thinking about what jobs I might go into. It hit me that I wanted to try to leave a legacy. Some people only give back once they've made a massive fortune, after they retire, kind of in the twilight years of their life. I wanted to have a successful career, but I wanted to be able to give back, and I didn't want to wait to do that. I wanted to figure out a way to infuse my career ambitions and my desire to give back.

It wasn't until a number of years later that I signed up for a rewards credit card. Towards the end of the year, I remember going on to my bank's website and browsing the rewards, products and chain’s gift cards, and thinking, “you gotta be kidding me.” I felt like I had been duped by yet another too-big-to-fail bank. The whole scheme of credit card reward points. Let’s face it, it's a gimmick by the bank, they're not giving away all this stuff because they're losing out.

I was frustrated. I remember as soon as I logged out of the bank's rewards catalog, I was checking my email, and a nonprofit I had previously supported sent me an end-of-the-year fundraiser email. That's how I connected the dots.

Being a younger millennial and consumer, I was aware of companies like TOMS’ and other social enterprises. I thought, what if we take it a step higher and people could use a credit card that makes a difference? I felt there was an opportunity to come to the market in financial services with an honest product and an honest company, led by an honest person, that’s all about doing the right thing.

You mentioned Charity Charge is a public-benefit corporation, what did you mean by that?

This was confusing to me when we first started.

We are a for-profit company, and as a for-profit, you can elect legally to become a public-benefit corporation. It is an actual legal designation at the state level.

What that means is that we have a dual bottom line or dual obligation. One is to serve the interest of our shareholders. But we also provide a benefit to society, and we do that with our product, giving back to nonprofits, and by underwriting the donation process.

How does Charity Charge make money?

We make money the same way that big brands with their own co-branded credit card programs make money. We're helping the bank get new customers by doing the marketing for them. They pay us an upfront fee. A portion of that we pass on to the cardholder's selected charity and then some of it helps us keep the lights on and have some sustainable revenue to grow the business.

Separate from the 1 percent that's set aside to the cardholder's charity, we also get paid by MasterCard and our bank what you can call a program manager fee. They're basically paying us out an incentive to operate and grow our card program.

What it was like to launch a company like this? What are some of the hurdles you had to overcome?

When I first got it started, I literally had no experience. I never worked for a bank, I never worked for a credit card company, a payment network, a processor, any of that stuff. So I went into this thing really cold and it's a super esoteric industry. While it's a big market, it's kind of a niche and the co-branded space is generally reserved for really large brands.

If you’re a bank, you want to work with big, proven brands, because they're going to have a big customer list. The whole reason that a bank does this kind of co-branding is they want to partner with a brand or an organization that can help them sign up new credit card customers. They want to go after the tried-and-true because they want scale.

There are a lot of payment consultants out there that represent brands and organizations when they structure these deals with the banks. I reached out to a bunch of these consultants at the time, and I got to know one of the consultants. He was really helpful, being friendly, offering free advice, and answering questions. Down the line, he ended up getting hired by MasterCard and that worked in our favor to help us get the deal with them.

How does someone qualify for the Charity Charge card?

There's not hard and fast cutoff. I will say that typically our bank partner, Commerce Bank, is approving FICO scores around 680 or above, but the decision depends on a host of other circumstances. We've certainly had plenty of people get approved below 680.

- No Annual Fee

- Low APR starting at 10.74%

- World MasterCard benefits

- Earns 1% Cash Back to ANY nonprofit of your choice including K-12 schools, colleges, & religious organizations

- Comes with all of the great benefits of a World MasterCard

- Support up to three nonprofits at once

I have other rewards credit cards that let me donate points. Why should someone choose Charity Charge over one of those other cards?

There are a couple of reasons.

- We've worked it out so that the donations from your card are tax deductible. With other affinity cards, the bank is making the donation, not the cardholder. So, by using our card, you’re helping a charity and could get a tax write-off.

- Another benefit is that we give a full 1 percent to the charities because we underwrite the processing fees. Some other cards don’t offer that much cash back or don’t pay the fees, even the cards that are co-branded with a charity.

- Also, you can choose to donate to multiple charities, with other affinity cards your cash back generally only benefits a single nonprofit.

My perspective is that the average consumer is going to have three to four cards in their wallet. I would love it if Charity Charge is your only card, but I want to be realistic. For the times you're buying a flight, maybe you want to use an airline’s card because you're going to get bonus points. No problem.

But what if 20 percent of the time you use Charity Charge and make a difference?

Does the Charity Charge card have any fees?

There's really nothing abnormal. There's no annual fee, but there could be fees for a late payment or foreign transactions. You can review the terms during the application process.

There's really nothing abnormal. There's no annual fee, but there could be fees for a late payment or foreign transactions. You can review the terms during the application process.

The company is less than a year old, what’s next on your to-do list?

We're going to be launching a corporate card version. Right now it's a card for consumers. The corporate version is a card that companies’ employees would use if they're making business purchases. The company can put their brand or logo on it. We see that as a way to increase and grow our missions of helping people give back to nonprofits that desperately need their support.

Leave a comment

CREDIT SCORE UPDATES

exclusive members-only deals