Closing You Credit Card the Right Way

Odds are you’ve taken a look in your wallet and realized you have more plastic than you actually need. Or maybe you’re trying to revamp your finances and want to cut back on your access to credit, so you won’t be tempted to overspend. Closing some of your credit card accounts may seem like a great idea at first, but if you don’t do it properly, it could have a negative impact on your credit score.

Is It Bad to Have a Credit Card You Never Use?

You may think keeping an open line of credit that you never use is a bad thing. After all, how will you resist the temptation to buy stuff you don’t really need if you keep it in your wallet?

However, keeping a credit card you don’t use could actually be good for your credit score

One of the biggest aspects of your credit score is the credit-to-debt ratio and having open lines that are unused makes this ratio look better than having a bunch of cards that are all maxed out. For example, if you have a credit card with a $10,000 line of credit but you only have a $200 balance, your score is likely to be better because of your low credit-to-debt ratio. In fact, no matter how much credit you have available, the less you spend, the better you look.

The trick to keeping a card you never use without it damaging your credit score is to use it once every month or two. If you simply use your card to make a small purchase and then pay it in full, you have activity on your card, and you can avoid paying interest on your purchase. Your spending ratio will remain low, and your account will remain active. Unfortunately, you do have to use the card periodically. Credit card companies monitor their accounts and if you don’t use your line of credit at all, they will eventually close the account themselves. The occasional spend will ensure your credit card continues to show as an open account on your credit history.

Image by myfico.com

Old Account Rule

Another way that an unused credit card can help your credit is if the account is an old account. If you have had your account for a number of years, you should think twice before you close the account, even if you don’t use the card often. This is because the longer your credit history, the better your credit score. And, if you cancel your old accounts and only have new accounts on your credit reports, your credit score could drop.

What Happens to Your Credit Score?

Two negative things can happen to your credit score when you close a credit card account. First, your credit-to-debt ratio could go up because you have less credit available to you, which can affect your credit score negatively. Second, you could see a decrease in your score if the account you close is an old account.

However, to say that your credit score will automatically go down isn’t necessarily accurate. If you are a younger person in your early 20’s with a very short credit history, closing a credit card is likely to hurt your overall credit score more because you have a short history with fairly new credit.

If you are constantly making late payments, paying off the account balance and closing the card may ultimately be the wiser and less damaging option.

Closing one credit card account because you opened another one with lower fees and a much higher credit line may not have as much of an impact on your score. On the other hand, paying off the balance on your old credit card and keeping it open after you open a second account could actually increase your score because your credit-to-debt ratio will be lower. More credit with less debt will result in a better credit rating.

How Much It Hurts Your Credit?

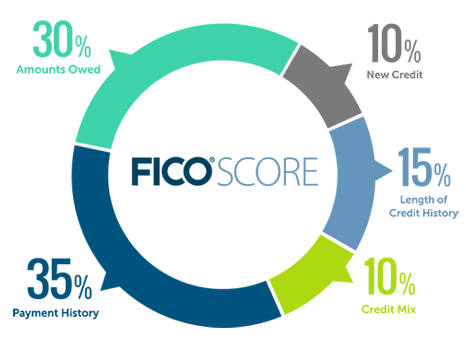

Your credit score is all about percentages and ratios. The amount of time you’ve had a credit history, in general, makes up about 15% of your credit score, so closing your oldest account will do far more harm than closing an account you’ve only had a few months. Accounts stay on your credit reports for up to 10 years, but if you don’t keep building your credit, you’ll see an unexpected drop later on down the line.

Your ratio of credit utilization can make up approximately 30% of your credit score, so closing an account with a very small line of credit while keeping your larger lines of unspent credit open will be less damaging. Closing the larger lines of credit will skew your credit-to-debt ratio, making it look like you’ve spent more of your available credit, thus dropping your score.

Which Cards Should You Never Close?

Some cards are better to close than others. When looking at your options, make sure you avoid the following mistakes:

- Don’t ever close your credit card account if it is the only one you have.

- Never get rid of the account with the longest history.

- Don’t close the only card you have with available credit.

- Never close a card that still has a balance. It makes it look like you have maxed the card out, which can hurt your credit-to-debt ratio.

How to Close a Credit Card Right

There are plenty of reasons to close a credit card, including new annual fees or a sudden spike in interest rates. It’s best to try to replace the offending card with one with better rates before closing out the account, though.

Once you have evaluated whether or not the closed account will affect your score negatively, and you have made the decision to close your credit card, keep the following in mind.

- Don’t give up any rewards you’ve earned. Check the redemption policies and find out the process for redeeming accumulated miles, points, or cash back that you earned as a cardholder. Redeem and use up the rewards you have available before closing the account. Otherwise, depending on the card terms, you could end up forfeiting your rewards.

- Pay off your entire balance. Call customer service to ensure no additional interest has accumulated since your last payment. Confirm that the balance is zero.

- Call customer service and notify them of your intent to cancel. Do not let them tell you that you cannot. It is your right to cancel.

- Put your cancellation request in writing, even if you have verbal confirmation. It is important to make sure you ask them to mark the account as “closed at the consumer’s request.” Ask for confirmation of the cancellation in writing. Mail your letter certified with a request for a return receipt, if possible.

- Follow-up in a month or two to ensure the credit card account is canceled.

- Check your credit report annually and make sure accounts you closed are marked correctly. If not, or if the entry isn’t marked at “closed at the consumer’s request,” call customer service again and ask for a correction.

- Keep notes with the dates, times, and the names of any customer service reps you speak to.

Closing a credit card account isn’t something to take lightly. Make sure you look at your entire overall credit history to be sure your decision to make a change won’t do more harm than good. Sometimes it just pays to keep those unused accounts open.

Leave a comment

CREDIT SCORE UPDATES

exclusive members-only deals