Credit Cards for Bad Credit - Best Secured and Unsecured Options

What types of credit cards are available for people with bad credit, how to apply for an unsecured credit card and how to rebuild your bad credit and maintain a good credit behavior – in our guide on credit cards for bad credit.

Jump to the section below or keep reading our guide.

What Is Bad Credit?

Bad credit can best be defined as a credit score that is in the poor or lower end of credit scores. If you have bad credit, it’s likely that lenders and credit card issuers will see you as a risk and either deny you credit opportunities, or offer them with high fees and interest rates attached. The good news is that sometimes consumers think they have bad credit when they don’t. In fact, your credit may not be as bad as you think.

In order to determine if you have bad credit, you will need to get your credit score. The scoring system most used by lenders is FICO, which can give you a good idea of where you stand in terms of your credit. Here is a quick idea of the FICO credit scoring system and what each level might mean.

- Bad credit: 300-629

- Fair credit or Average: 630-689

- Good credit: 690-719

- Excellent credit: 720 and up

Even if you find that you have fair or bad credit, you do have options. And, if you work on your credit rating, you can eventually increase your credit and reach the good and excellent levels that many consumers strive for.

Why You Need a Credit Card with Poor Credit

Many people think once they have bad credit that they are stuck with it and can’t do anything about it. However, one of the easiest ways to improve your credit is to get a credit card and manage the account responsibly. Your activity will be reported to the credit bureaus, and over time, your credit score will increase.

Keep in mind, however, that credit cards for people with poor credit often include small credit limits and high APRs. In fact, many can end up costing you quite a bit, especially if you don’t manage the account properly. Some of the things you should look out for before selecting a credit card if you have poor credit include the following:

- Does the card issuer report to the credit bureaus?

- How much are the card fees?

- What is the APR?

- Can you avoid paying interest?

- Can you make your payments on time?

How to Apply for a Credit Card with Bad Credit: 4 Step Guide

Not sure how to apply for a credit card with bad credit? Here is a 4 step guide that can help get you going.

Step 1: How Bad Is Your Credit?

First, it’s important that you know where you stand credit-wise. You may not even have bad credit and if this is the case, you can qualify for cards with lower fees and higher limits.

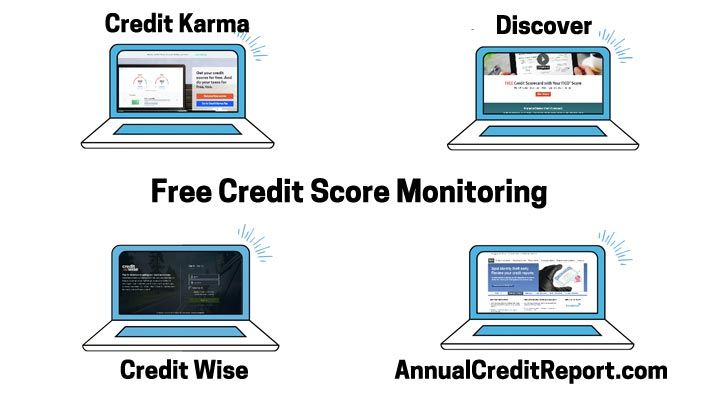

You can check your credit score free in many places, including through Discover Bank (our recommended option – real FICO score for free!), Capital One Credit Wise, Credit Karma, creditsesame, Quizzle, and other free credit score services. If you need more information on checking your score, make sure you also take a look at our guide on a free credit score.

You can also get your credit reports and an idea of where your credit might be at annualcreditreport.com (free official FICO score that is free one time per year). Since you will need your credit reports anyway, it’s a good idea to access your free report every year, which is not only free but also the most comprehensive one.

You can also go directly to myfico.com, which is a consumer division of Fair Isaak Corporation, and sign for a FICO score monitoring and access, but it costs a fee to access.

When you have your credit reports, examine them thoroughly for any information that might be outdated or incorrect. If you find any errors at all, you can dispute them online or in writing. The credit bureaus must then investigate the errors and correct them.

Other areas you should consider that can potentially bring down your credit, include the following:

- Debt to income ratio: Do you make less than you owe?

- Employment: Is the employment information correct on your report?

- Have you made all your payments on time?

- Have you filed bankruptcy?

Step 2: Decide on a Secured or Unsecured Card Option

Once you have determined what your credit rating is, you can begin to figure out how to get a card to improve your credit. The first question is whether or not you should choose a secured card or an unsecured credit card to get started.

The primary difference between the two is that secured cards generally require security deposits of at least $250, that the card issuer holds in case you default on the account. In the meantime, you get a credit card with a limit in the amount of the deposit. Sometimes the deposit is held in an interest-bearing account, which can result in an opportunity to earn a little extra while you have your account. As you make your payments and manage the account, your activities are reported to the credit bureaus, which can help you build a better credit rating. Once you have improved your credit, you can get your deposit refunded and possibly qualify for an unsecured credit card.

Can You Get an Unsecured Card?

Many people with bad credit automatically assume that they will only qualify for a secured credit card. However, there are unsecured cards available that you might qualify for without paying a security deposit. If you aren’t sure if you will qualify for an unsecured card, you may want to choose one with a prequalification process such as Credit One, before you decide.

Pros and Cons of Secured and Unsecured Cards

Both options are not perfect – but with a bad credit you shouldn’t expect perfect offers available right away.

Secured Cards Pros

- Bad credit is okay, easy to qualify

- Helps build credit like a credit card

Secured Cards Cons

- Security deposit required

- Higher APR

- Higher fees

- Low credit limit available

Unsecured Cards Pros

- No security deposit required

- Builds credit score fast, skipping the secured card step

Unsecured Cards Cons

- Higher fees than credit cards for better credit.

- High APR than credit cards for better credit.

- Low initial credit limits, hard to maintain low utilization ratio

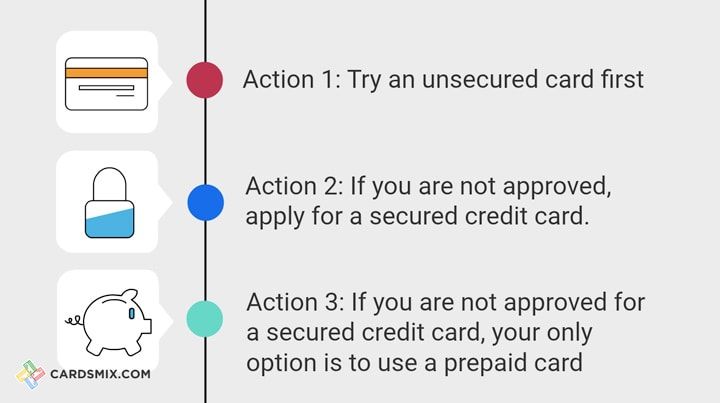

Action Plan for Getting a Credit Card

It can be confusing trying to determine which way to go when you are building your credit rating. Here is a simple plan to follow that might help guide you.

Action 1: Try an unsecured card first. If you are approved – great!

Action 2: If you are not approved, apply for a secured credit card. If you are approved for a secured card, plan to manage the account and improve your credit score so that you can graduate to an unsecured card in the near future –- it takes 6 to 12 months usually. Use your secured card, make your payments on time, build your credit score, and work toward getting your score into the good and excellent ranges.

Action 3: If you are not approved for a secured credit card, you may want to try a card issuer that guarantees approval. If you just don’t meet the requirements, such as you aren’t able to get a bank account or pay the security deposit, your only option is to use a prepaid card. Because a prepaid card won’t help you improve your credit, it’s important that you work on meeting the requirements for a secured credit card and improving your credit.

Step 3: Use Your Credit Responsibly and Rebuild Your Credit

Whether you choose an unsecured card or a secured card, it’s crucial that you focus on managing your credit responsibly. Otherwise, you just risk making your credit worse. Some of the things you need to keep an eye on while rebuilding your credit include the following:

- Monitor your score. Even with bad credit, make sure you continuously monitor your score to see where you need to improve or make corrections.

- Keep your utilization low. It’s recommended that you keep your total amount due at 30% or below your total available credit. Do not max out your credit line, or you risk lowering your credit score further.

- Pay on time. Making timely payments is one of the most important parts of a good credit score. Make sure you do not make late payments. It may be helpful to set up payment reminders and automatic payments to ensure you pay on time.

- Ask for credit line increases. Most secured cards will allow you to add to the deposit to increase your credit line, but you might also qualify for an increase without an additional deposit. Ask your card issuer if this is an option. Also, don’t be afraid to ask when and if graduating to an unsecured credit card is an option. Many card issuers will evaluate your account after the first 12 months to see if you qualify for an unsecured card instead.

Step 4: Get a Card for Average or Fair Credit

Once you have improved your credit and reach 650+, it’s important that you continue to work on improving your credit score. At this point, you can usually qualify for a credit card for average or fair credit or even good credit, which comes with better terms, more benefits, lower APRs, and rewards programs.

How to Raise Your Credit Score in 30 Days?

It can’t usually be done overnight, but there are ways to increase your credit score quickly. For instance, you can clean up your credit and catch up late or missed payments, you can pay off debts and collection accounts that are less than 24 months old, and you can set automatic payments to ensure you don’t miss any payments in the future.

Further, you can improve your credit significantly if you pay off a balance or request a credit limit increase, simply because this lowers your card utilization ratio. It is also helpful to get added as an authorized user to your parents or spouse’s credit cards, especially if they are old accounts with high credit limits. More on the ways to raise your credit in our article.

Best Credit Cards for Bad Credit

Once you have figured out your credit rating and you have a plan in mind to improve your credit, you will need to choose a credit card. Here are some things you should consider if you are choosing a card to use to improve your credit.

- Qualification. Find out what you need to qualify for the card and if there is a prequalification process before you apply. This allows you to find out if you have a chance of getting the card before you rack up a bunch of credit report inquiries that can lower your score even further.

- APR. The interest rates for credit cards for bad credit are going to be much higher than you would find on other credit cards. It’s important that you find out how long the grace period is (if there is one) and pay your balance in full during this time to avoid paying high interest rates. Otherwise, you risk getting even further in debt and damaging your credit. Because of the high APRs, it is also best to only use your card for amounts you know you can pay off right away.

- Processing fees. There shouldn’t be processing fees for credit cards, but sometimes cards for bad credit include more fees and higher fees. Make sure you check and see how much any fees, including processing fees, are included with the card you apply for.

- No or low annual fee. There are annual fees for cards that are designed even for people with excellent credit. If you have bad credit, you may find it difficult to get around this fee. Try to find the cards that have the lowest annual fee or none at all, if possible.

- Security deposit. If you are going with a secured credit card, find out if your security deposit earns interest and if you can get a refund of your security deposit and graduate to an unsecured card over time.

- Checking accounts. It is hard to find a card that can be opened if you do not have a checking account. Most cards require a savings or checking account to debit the deposit from or just as an additional security check. However, there are cards that might allow you to send in or pay your deposit another way.

- Credit limit. You should have a clear idea of the credit limit before you begin using your card so you don’t inadvertently go over.

- Credit bureau reporting. One of the most important features is whether or not the card issuer or bank reports to the credit bureaus. If they do not, the card will not help you improve your credit.

- Card benefits. Credit cards for bad credit don’t always come with extra card benefits, but some do. Check to find out if there are features such as free credit monitoring, free credit scores, or travel benefits.

Best Unsecured Cards for Bad Credit

There are unsecured cards for bad credit that will help you improve your credit score. The following are our picks for the best unsecured cards for rebuilding credit.

Cash Back Rewards

With No Annual Fee

Most of the cards for bad credit have a range of annual fees. The actual fee you will be paying is determined by your credit rating, so you can qualify for a card with no annual fee or you can get an annual fee version of the same card if your credit rating is lower. Even though some customers can qualify for a zero annual fee version of several cards with bad credit, it is not guaranteed, so we chose to not list any cards in this category to avoid confusion.

Cards after Bankruptcy

If you have filed bankruptcy, you could find it difficult getting approved for any card. The Milestone card, however, includes a prequalification process, so you can find out if, according to your total credit outlook, you qualify before you actually apply for the card.

Best Secured Cards

There are many secured cards available, but sometimes it’s best to look at what is different between them to find out which one is the best for you. Some of the best secured cards include the following:

Miles Rewards Cards

$25 annual fee

$0 first-year fee

reports to credit agencies

24 days grace period

unsecured card offer after 12 months

There aren’t many secured cards that offer miles rewards. The AeroMexico Secured is one of the best for earning miles that you can redeem for award flights with AeroMexico. If you travel, this is one of the only secured cards available for earning travel rewards.

Cash Back Secured Cards

The Discover it Secured is often considered one of the best secured cards available because it offers a rewards program similar to the program available with unsecured cards. You can earn cash back with this card that you can’t earn with other secured cards, plus it comes with other features such as free credit score and no annual fee.

With No or Low Annual Fee

The Capital One Secured Card includes one of the lowest annual fees found on any secured credit card. It also comes with other features that could be helpful while you rebuild your credit, and is backed by a well known card issuer.

Low APR Secured Cards

If you are looking for a secured card with the lowest APR, you have a couple options available, although most are credit unions that require membership. The DCU Platinum Secured card offers an APR as low as 11.99%, which is low even when compared to unsecured. Cards.

The SDFCU Secured card comes with an APR of 6.99%, which is lower than almost any credit card available. If you consistently carry a balance, a card such as this one could end up saving you the most money while you build your credit.

Best Secured Cards for Business

If you are a business owner, you might want a secured business card to help improve your score and keep your personal and business finances separate. Our picks for the best secured cards for business include the following:

One of the benefits of the Wells Fargo Business Secured Card is being able to establish business credit with one of the largest banks in the country. You also have the option with this card to either earn cash back or rewards points when you use your card.

The BBVA Compass Business Secured Visa is another secured business card backed by a large financial institution. This card comes with helpful features such as the ability to manage employee business expenses with online tools and integration of expense data and reports, making it easier to keep your business and personal finances separate.

Best Student Cards

There aren’t usually student cards that are secured, so you have to choose one or the other. One of our recommendations for the best student card is the US Bank College Visa Card, which will help you improve your credit if you have bad credit simply because you are just starting out.

Store and Gas Credit Cards

Store cards are some of the easiest cards to qualify for, even if you have bad credit. This is because store cards typically carry high APRs and fees, and often can only be used with a specific retailer. The good news is that store cards can also help you improve your credit if you manage your account responsibly.

If you have a high number of inquiries on your credit report from applying for credit, you might want to consider using the shopping cart trick when you apply. This method allows you to find out if you qualify for a store card, without a hard inquiry on your credit report. It involves accessing retailer website such as www.Walmart.com, joining the loyalty program (or skip and checkout as a guest), add items to your shopping cart, and then begin the checkout process by entering your address. In order for this trick to work, it’s important to make sure your address matches the address on the credit reports. You should get an offer for a credit card before you reach the final payment page of the site.

Gas credit cards are also easier to qualify for if you have bad credit. Like store cards, they often carry a higher APR and can only be used at specific gas stations. Still, many of these cards provide rewards or benefits when you fill up and can help you build your credit score if you have bad credit.

no annual fee

not a major card - you can use it at Marathon stations only

good for rebuilding credit

Prepaid, Debit, and No Credit Check Cards

For the most part, if the account does not require a credit check or is considered a prepaid or debit account, there probably won’t be a credit bureau involved. This means that these types of accounts will usually not help you build or rebuild your credit, but are usually, at least, guaranteed approval. There are also prepaid accounts that do not require a bank account, which can be helpful if you have faced challenges opening a checking or savings account. Some of the best prepaid, debit, and no-credit-check cards include the following.

The Amex Serve card is a prepaid account that is well known and popular simply because it is backed by American Express and carries fewer fees than other prepaid cards. If you want to start a relationship with American Express and you have bad credit, this could be one of the ways to do it.

The PayPal Prepaid cards typically use the funds in your PayPal account, similar to a checking account. These cards can be extremely useful if you shop online or manage your finances primarily online.

All Credit Cards for Bad Credit

Here's our comprehensive comparison of the best bad credit card offers available today. When comparing cards consider filtering the category you are looking for - i.e. secured, unsecured, prepaid, and then sort card by APR, Annual Fee and other features. We calculate total annual rewards for every card, using a model of average spending, you also can adjust it to your spending patterns.

Bad Credit Loans

You may also qualify for a bad credit loan, which can be extremely helpful if you need to consolidate or pay off debt that charges a higher interest rate. Our recommendation for a bad credit loan is Lending Club or Lending Tree, which has been known to provide loans to those with credit scores as low as 600 FICO which is closer to an average credit . As with credit cards, however, keep in mind that any loan you qualify for while your credit is bad, will likely charge a higher interest rate than normal.

How to Rebuild a Credit Score

It might seem like a long journey, but rebuilding your credit can be easier than you think. For the most part, you need to be diligent in managing your accounts responsibly, making payments on time, and not missing payments. And, one of the fastest ways to get started, is by using a credit card, whether it’s a secured card, unsecured, store card, gas card, or other type of credit card for bad credit.

Rules of Good Credit Behavior

It’s best to start living by the rules of good credit behavior, even while you are building or rebuilding. Keep these rules in mind to get good credit and keep it.

- Always make payments on time.

- Do not overspend.

- Stay below 30% of your available credit.

- Pay your balances in full each month.

- Keep open old accounts and use them occasionally.

How to Avoid Hurting Your Credit Score

While rebuilding your credit you also have to be careful that you don’t hurt your credit score. You don’t want to ruin all your hard work only to end up with bad credit again. To avoid hurting your credit score, you might have to set up automatic debits to ensure you pay on time, or you might have to put your cards away occasionally to keep from overspending. Although it seems like it could be long and difficult, it will be much easier to keep your good credit once you get there.

Leave a comment

CREDIT SCORE UPDATES

exclusive members-only deals