How to Ask for a Credit Line Increase?

Who doesn't want more credit? You get a credit card so you have access to a line of credit, but also so you can build your credit history. The more credit you have available, when balanced correctly with what you actually use, the better your credit score will be in the future. When it comes to getting a credit line increase, you can either ask for one or wait for an automatic increase that usually comes over time.

Most credit card companies don't just look at your credit history with them, although that is a factor. It’s also important to have a line of credit with the issuer for a certain period of time –- normally at least six months –- before they will even consider an increase, and you won’t usually get approved for a credit line increase more often than every six months. To give yourself a better shot, make all your payments on time on all accounts including card companies as well as others. Pay more than you need to, and keep your balance low. Your best shot at getting a credit limit increase with most banks is to make sure you manage the account you have with them responsibly.

Capital One

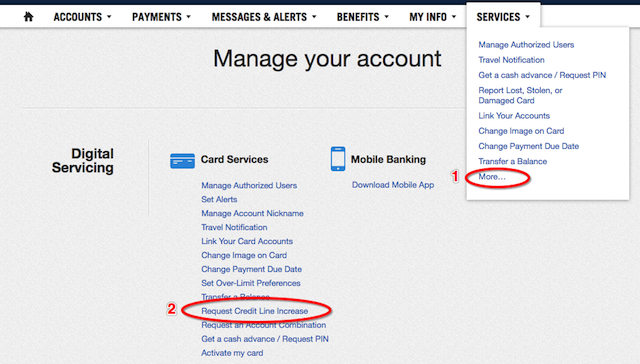

Capital One sometimes gives credit card users automatic credit increases based on your activity. You can also request a credit limit increase through your account online or by calling. Capital One even offers a credit monitoring app called CreditWise, which can help you manage your credit and keep track of your credit score.

To ask for an increase - just log into your account with Capital One, navigate through the menu and find the "Request Credit Line Increase" item. You'll be forwarded to the online form to reevaluate your credit limit. The decision is almost instant.

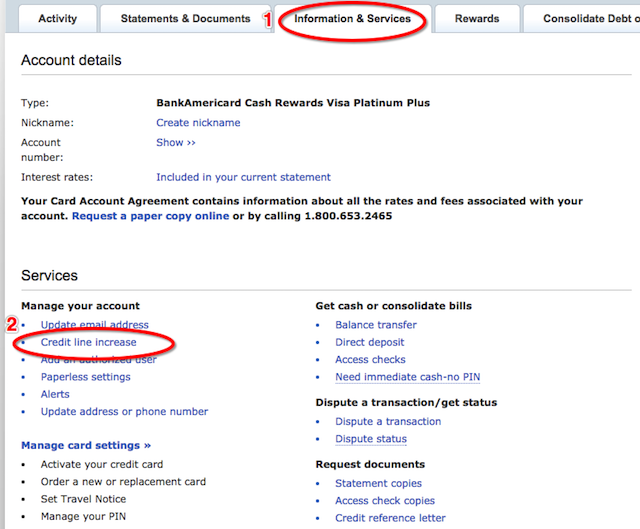

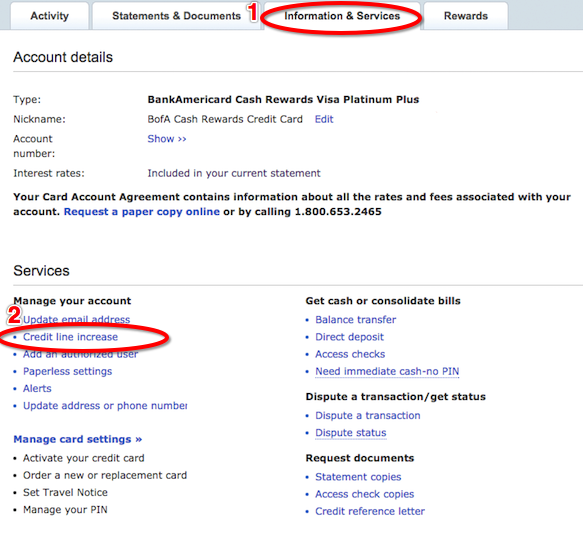

Bank of America

Bank of America, like other companies, will sometimes increase your line of credit without asking, but if you want a higher credit limit before it's offered, you can apply for an increase online. Small increases call for a soft inquiry, while large increases might require a hard inquiry into your credit history. Generally, you need to be a customer for at least six months before increasing your credit line.

Chase Bank

To increase your credit line with Chase, you'll need to look on the back of your card and call the phone number to speak with a representative. Chase is one of the few credit card issuers which will not allow you to request a credit limit increase online. However, you don't have to worry about their credit checks showing up on your report if it's an automatic increase, as this is usually a soft inquiry.

Discover Bank

Discover allows you to request an increase online. However, you aren’t able to ask for a specific amount. The request will require just a soft inquiry and give you the option to cancel the process before they move on to a hard inquiry. If you do get approved, and you don't want as much credit as they offer, you can reduce the amount, but you can't increase it. This is another company that seems to be generous with automatic increases, so it might be less hassle just to wait it out and work within your existing budget.

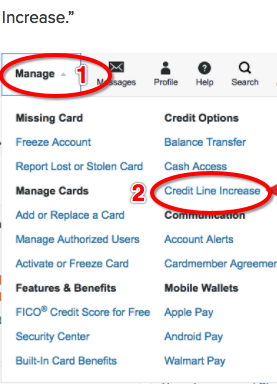

Citibank

Citibank allows you to apply for an increase online, and you may get your increase immediately through the automated process. However, if there are any red flags and you don't get the increase right away, ask for a manual review of your account by a representative instead of relying on the automated system. If you're not in a big hurry, don't even worry about it. This company tends to increase credit lines every six months as long as you are managing your credit as you should be.

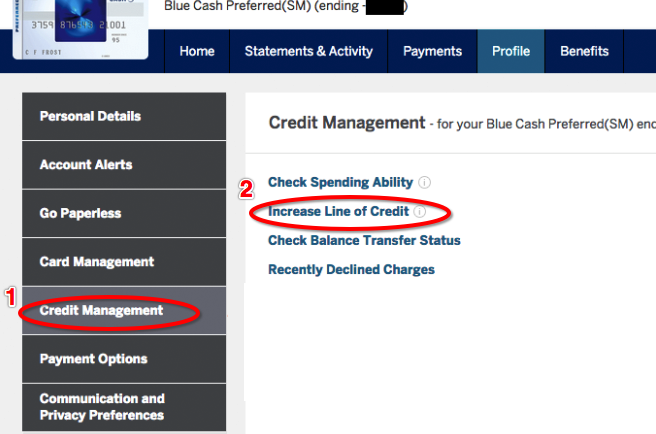

American Express

If you want a credit line increase from American Express, you can request one through your online account. Just keep in mind that each request is met with a hard inquiry that shows up on your credit report. This means unless you are confident that you will get approved for an increase, it really isn't worth it to just take a shot at it. American Express does not give increases to anyone who has been with them for less than six months and won't even consider it if your account isn’t at least 60 days old.

Banks that offer credit limit increase

| CLI can be asked via | Issuer | How Affects Credit Score? | Comment |

|---|---|---|---|

| online | Capital One | soft pull | can do every 6 months, sometimes need a phone call to get CLI |

| online | Bank of America | hard pull | |

| phone call only | Chase | hard pull | |

| online | Discover | either hard or soft pull | |

| online, in app | CITI | can be either soft or hard pull, they tell you before the pull | |

| online | American Express | soft pull | Easy to get a big increase |

Credit Line Increases and Your Score

If you already have a credit card, your score may not be the most important thing they look at when you want an increase. At the same time, it can be the most important element to other potential lenders. With the right tools, you can increase your score and your credit line at the same time. The following tips will help you get a higher credit line as well as a better credit score.

- Use AutoPay or set alerts. Late payments are most certainly going to keep you from getting an increase, especially if you have been late with that particular creditor within the past 12 months. Using features such as AutoPay or setting up notifications and alerts can help you make sure that your payments go in on time, every time.

- Keep Active. A lot of people think if they just don't even use their credit cards, they can improve their credit. However, the opposite is usually true. Lenders want to see that you can use your credit responsibly, which means keeping active. Use your card, but make sure you aren’t making purchases that are outside of your budget. Most of the time, using your card to make payments you would typically make anyway, is enough activity to get a credit line increase.

- Consider the Type of Inquiry. Soft inquiries don't affect your credit score, so whether you are approved for a credit increase or not, it can’t hurt to request if a hard inquiry isn’t involved. If the credit limit increase requires a hard inquiry, it could impact your credit negatively, especially if you have a large number already on your credit reports. For many lenders, a large number of hard inquiries can indicate a risk of default. Instead of pushing the bar with these companies, just have patience and let them offer you an increase on their own.

The bottom line? Keep your balance below 30% of the credit available, pay more than the minimum monthly payment that is due, and make your payments on time, all the time.

Use your credit card for purchases you would typically need to make anyway, and make sure you use your credit responsibly. Avoid unnecessary requests for increases so you don't have a flood of hard inquiries on your credit report. If you can follow these guidelines with all your credit accounts, you won't have to ask for an increase because you will most likely be offered higher credit limits on a regular basis.

Leave a comment

CREDIT SCORE UPDATES

exclusive members-only deals