Money tips for Europe trips

The summer is getting close and we are starting to plan our vacations. With a Euro currency showing new lows, more and more Americans are going to visit Europe this year.

How to avoid disappointment while reading your credit card statement after your trip?What is the best option for currency conversion overseas?

We will answer these questions based on both recent research data and extensive field practice during many Europe trips.

Cash is not the king

“I’m so used to exchanging money for my vacation right at the airport currency exchange office. I never thought that credit cards offer much better exchange rates, before my friend explained me once. I was surprised how much money I gave out in commissions and exchange rate difference”, says Patricia Baker, who lives in Nashville, TN

Recent findings show that the most effective tool for currency exchange for travelers is a credit or debit card that automatically makes currency conversion based on payment system rates (VISA, MasterCard or American Express). The research shows that when exchanging currency at US banks, you can lose up to 11% on conversion comparing to VISA or MasterCard rates. Needless to say, exchange rates at popular tourist locations are even less favorable.

Rule #1: It makes perfect sense for travelers to pay with a credit or debit card wherever it is possible.

You still need some cash

Sometimes it is necessary to carry some cash – for taxicabs, souvenirs, tips or locations that do not accept credit cards.

The cheapest way to withdraw foreign currency in cash is through the ATM. Be aware of high fees for cash advances on credit cards and cash advance interest rates, which can be substantially higher than regular APR and does not get you a grace period.

It is a good habit to carry a debit card with a low international ATM fee in your wallet for that purpose.

I can recommend using a CapitalOne360 card – the bank waives an international ATM fee for its clients.

Charles Schwab debit card as also a good option – they charge no ATM fee and reimburse the fees charged by other counterparts (bank – ATM owner and payment system, for instance).

Card currency conversion basics

What happens when you pay in Euro using your credit card? When you swipe your card for your purchase in Euro, payment system (VISA, MC, AmEx) converts the sum to its billing currency using internal conversion rates (usually very good ones), then the payment system handles this bill to your bank, and the bank finally bills you at the end of your billing cycle.

You can find payment system conversion rates online – for VISA and for MasterCard.

What is a dynamic currency conversion (DCC)?

This is an option offered to you at the point of sale to use your home currency (USD) instead of local currency for your purchase. For example, a cashier can ask you if you prefer paying in USD or in Euro.

If you opt for DCC at the point of sales (answering “I will pay in USD” in a natural response) then the conversion will be processed by a local merchant or credit card processor based on the rates, that are usually less favorable to the cardholder than those offered by VISA or MasterCard. Some providers additionally charge an extra fee, which can be as high as 3% of a transaction amount.

The only benefit of DCC worth mentioning is that it shows you the full amount of payment in USD at the point of sales, instead of getting it in your credit card statement after the settlement of a transaction.

Rule #2: We recommend you never using DCC and always opt for paying in local currency wherever you are.

Be aware of international transaction fees

When you make a purchase overseas, or even just shop at a foreign online store, US banks usually charge you a foreign transaction fee, which is typically 2-3% of the transaction. Some banks do not charge this fee on their whole card lineup (Discover, Capital One), others have special travel card products with no international transaction fee.

You can find our full list of cards with no international transaction fee here. Using the card with no fee can save you 2%-3% on all your transactions in a foreign country.

Smart chip cards trap

“I was standing on the railway station early in the morning, exhausted all my options to buy tickets. I had only 3 hours before my plane departure from Paris Charles De Gaulle Airport and I was feeling nervous. Ticket vending machine rejected both my American credit cards; the explanation on the display were in French, which I do not understand. My savor was the first morning live human clerk in the ticket booth”, says Joanne Richardson, marketing professional from LA about her first encounter with Europe payments culture and technology.

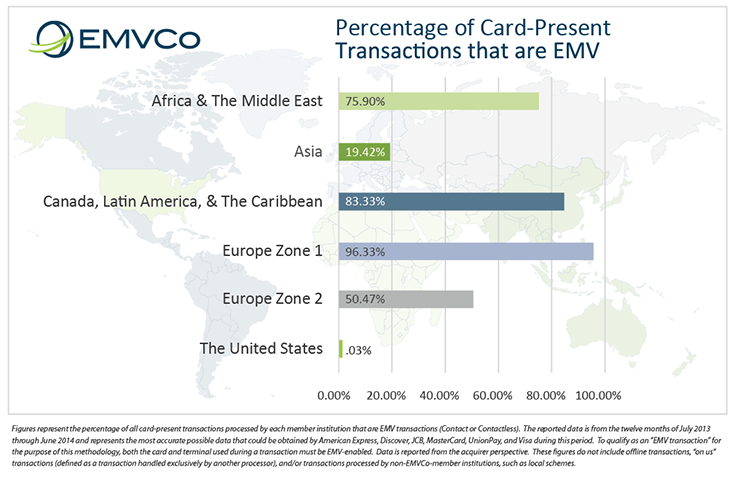

Europe has adopted a more secure type of credit cards – chip-and-PIN or EMV smart chip cards that are not widely accepted in the US yet. These cards have an embedded chip that handles encryption and significantly improves cards security. While more US banks are now issuing smart chip cards for travel products, many US customers still own only old-school magnetic stripe cards (see the illustration by EMVCo )

The problem comes when you try to use your magnetic stripe card in Europe in one of the automated kiosks or vending machines. Many of them reject American cards that doesn’t have chip on them. You can have unexpected problems at train stations, toll roads, ticket machines in museums. Sometimes it helps if you know the PIN, otherwise you need to use cash or find a live cashier (that can be a problem during late or early hours). ATM should work fine for you with any type of card, so the best backup plan is to draw some cash and use it for your payment.

The best way to avoid this issue is to get a smart chip credit card for your travel needs. It helps that most traveler-focused credit cards in US are now issued with a chip on the card and the majority of new issued US cards in 2015 will be EMV compatible.

Hope our advice will help you to enjoy your summer and keep your finances safe.

Leave a comment

CREDIT SCORE UPDATES

exclusive members-only deals