Affirm Offers a New Way to Finance Large Purchases

Buying new furniture, appliances, or a mattress can be expensive. You might be able to finance the purchase with a credit card, layaway, a retailer’s financing plan, or a personal loan, but each has its pros and cons.

Affirm, which launched in 2013, partners with retailers to offer a new financing option to customers. When you check out at a partnered store, you can select to pay with Affirm and choose one of the available short-term loan options. There’s a quick application process and if approved you’ll know exactly how much you have to pay each month and when your purchase will be paid off. Unlike other financing options, there aren’t any fees to worry about — there isn’t even a late-payment fee (although paying late could still hurt your credit).

We spoke with Christina Ra, Head of Communications at Affirm, about the company’s founding and its loan product.

Louis DeNicola: What is Affirm?

Christina Ra: I'm going to give you a two-part answer. The first one is around the mission of Affirm, and why Affirm was founded. Max Levchin and the other founders of Affirm believe that there is a better way for consumers to deal with their finances.

The finance industry as a whole sort of monetizes or creates revenue streams around your mistakes as a consumer. There are so many hidden and surprise fees, late fees, and there's compounding interest. The founders wanted there to be a better way.

Affirm is a way to pay for larger purchases for folks who either don't have or don't want to use a credit card.

The ways in which it's different is that it's simple interest and it's a close-ended loan. A lot of people like to call it a microloan. Our average loan is typically around $700 to $750.

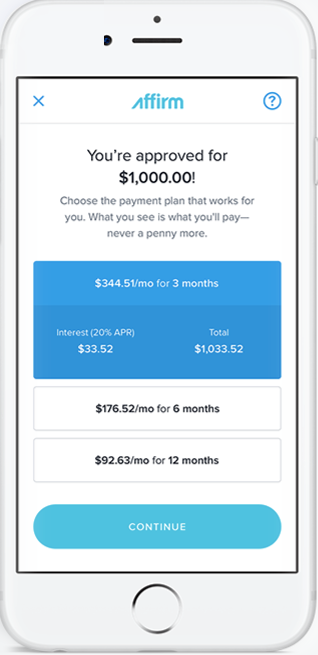

We can tell you to the penny how much you're going to pay for the purchase, and to the penny how much you'll pay per month. You choose your loan term, and it's super transparent. There's very little to be confused about.

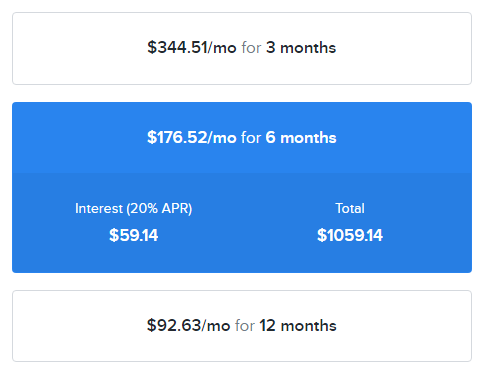

We partner with nearly 900 retailers as of now. On these retailers’ websites, you'll see an option to pay with Affirm. If you choose to apply, and if you are approved, you'll see several options. Typically, a three-, six-, or 12-month loan options.

This is the first product from Affirm. The reason I mention the long-term mission is because the goal is to bring other products to market. They'll have a similar sort of tone or flavor to the current point-of-sale products that we have.

The goal is hyper-transparency, simplicity, providing a way for people to manage their finances and pay for things in a way that makes them comfortable and confident.

You mentioned nearly 900 companies. Are there a couple of big names that spring to mind?

The ones that are probably best known are Wayfair, Casper, Expedia, and BCBG.

What's nice is say you were looking for a new mattress and you happened to be on Casper's website. The pay-over-time offers let you see what you would have to pay for a certain number of months.

The feedback that we've gotten is that the monthly payments really help people see a larger purchase through a different lens. It makes it more affordable, it gives them a very clear idea of how much they’ll spend, and they can budget accordingly. It's nice in that gives that option.

You also mentioned people have to apply for or get approved for Affirm. If they're approved, what determines someone's APR?

The first thing that I'll mention is that it's super easy to apply. We only need five pieces of information: your name, the last four digits of your Social Security number, your email address, your phone number, and your date of birth.

With that, we do our own assessment of your willingness and your ability to repay the loan.

We don't use a FICO credit score as the foundation of our approval process, which is one of the things that makes us very different than a lot of other companies.

I can't really go into a list of things that we look for, but the two things that we're trying to figure out is your willingness and your ability to repay. We ping a bunch of databases to get the information.

Does Affirm do a soft pull on someone's credit report?

Yes, we never do a hard inquiry.

[A hard inquiry is when a lender looks at your credit report to make a lending decision, and they could temporarily lower your lower score. A soft inquiry doesn’t hurt your credit.]

I read that sometimes people need to connect an online checking account and you can use that information to help approve your application or not. What might prompt that requirement?

If you aren't fully approved upon applying, there are other things that we can do, like take a down payment towards a purchase. So, we are able to service some customers who wouldn't ordinarily be able to get credit elsewhere.

Are there any other fees that people should be aware of before using Affirm?

No. There's nothing else, just the interest that you pay. That's one of the things that makes us unique is we take a lot of pride in what we've created as far as our underwriting goes and our fraud protection goes.

We don't have any other revenue sources, so we have to get this right. We're only going to lend the people who can repay us, and we've done a good job of doing that. We've been able to extend credit to a lot of people, so it's worked out well.

Once someone has a loan to Affirm, how do they go about repaying it?

The most popular option is people enroll in auto-pay, which deducts your monthly payment every month. Then, aside from that, you can pay through our app or online.

What happens if someone can't repay the loan? Is there a way for them to defer payments or make a new agreement?

All sorts of things come up, and we evaluate on a case-by-case basis. We do encourage our customers to call us if something comes up. We've had people come up with medical expenses and things that make it difficult for them to pay, and we try to do our best to work with people.

From a more logistical level, we talked about the fact that there are no fees or penalties or things of that nature, but we do report repayment to the credit bureau.

The reason we started doing that is a lot of our customers — I think a lot of people in general and especially Millennials — are trying to build their credit. That reporting is very helpful for them if you repay, which the large majority of our customers do.

If people do not repay or if they miss payments, that will reflect negatively on their credit report. It's something for people to keep in mind.

Do you report payments to all three credit bureaus?

We currently report to Experian, and we hope to report to the other major ones, Equifax and TransUnion, in the coming months.

What happens if someone makes a purchase with Affirm and then decides to return the product?

You get your money back from us, and we work that out with the retailer.

Are there any situations when people might want to use a credit card instead of Affirm?

Affirm is for somebody who is planning to pay for a purchase over time. Our interest rates are as low as 10 percent, which tends to be on the low end for credit cards. We also develop unique programs with certain retailers, and they can choose to implement 0-percent financing or some other special program.

When we look at Affirm customers as a whole, we see a broad range of ages. We see Millennials, we see Gen Xers, we see baby boomers. All of these people are using the product, and there's a pretty healthy mix across the board.

There's also a very healthy mix of credit tranches. We've got people with fair credit, good credit, excellent credit, super prime credit. A lot of folks are choosing to use Affirm because they like how transparent and simple it is to use.

If someone makes larger purchases and pays off the credit card bill every month regardless, in that case, Affirm is not the right option for them. They're not going to pay any interest, and they're going to get their credit card rewards.

But a lot of people avoid credit card use or don't have credit cards because they don't like the uncertainty that they bring.

They're afraid that they can get in over their heads, they feel like it's a little bit less predictable to manage.

What other products or services might Affirm release in the future?

Unfortunately, I can't go into a lot of detail about future products, but there are a lot of things that people rely on. We see opportunity throughout consumer finance to bring a more consumer-friendly, simple, and transparent way of doing things. We're always exploring our options, but the road is long. We want to do as much as we can.

Is there anything else you’d like to share?

We are doing this for the consumer because we think that there's a better way. What's been really interesting is that we see consumer behavior and sentiments about credit are changing. Especially with the millennial generation, there tends to be this aversion to traditional credit cards because of the uncertainty that they bring. We've been embraced because we offer something different.

Leave a comment

CREDIT SCORE UPDATES

exclusive members-only deals