Credit card car buying guide - why use credit card for car purchase?

You might have a few reasons to put your next car purchase on the credit card - from getting reward miles to financing a car down payment.

The real question is if it is actually possible to buy a car with a credit card – there is no short answer and the devil as usual is in the detail.

Can I pay with the credit card? Yes, but...

Generally, a dealership has a special policy on how much you can pay with the credit card. In most states, the majority of auto dealers put a limitation of $3000-$5000 on credit card transactions. Thomas from Oregon, OH, planned to put his new $25 000 Toyota Camry purchase on the credit card when he found out that all dealers nearby have a similar $3,000 limit.

“The $3,000 credit card limit policy is pretty common. I called Toyota, Lexus and BMW, and they all said $3000 is the maximum you can pay with the credit card. The rest must be financed by the bank loan, paid in cash or cashiers check” - Thomas said.

If you are buying a used and inexpensive car, you sometimes may be able to pay the whole price with the credit card. That happened to Frederick from Florida who found a bargain deal for used 2004 Honda Civic in South Carolina. Price had dropped from $6000 to $4500 and Frederick was ready to pay ASAP. Paying full price with the credit card added confidence in closing the purchase:

“I didn't want to miss the deal and come later to find out someone walked in with the cash right after my call, so I paid in full with my credit card and came a few days later to pick up the car. It was fast and smooth transaction and worth to make a trip out of state”.

Starting price negotiations with a question about credit card payment option is not the best tactic. High merchant fees - up to 3% could eat a big share of dealership profits - 3% out of $25,000 car is a $750 taken from dealer’s pocket. Keeping your credit card question until the paperwork is done can add you more arguments for final negotiation. Eric from Lexington, KY tells his story:

“I went in to buy a Chrysler 300 today. Negotiated and came to a final price of 17k after some haggling. We did the paperwork and then I whipped out the AMEX Plat. They were shocked. They offered to put 10k on it, but I threatened to leave. They pulled the general manager out and he gave me the spill on how much money the dealership is losing and that I'm getting a great deal”.

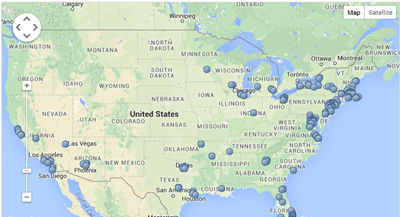

Sometimes paying for a car with a credit card is easy. A number of dealerships has an agreement with American Express and allow you to pay the full price of the vehicle with an AmEx card. You can find your local dealer offering this option on the interactive map at https://carpurchase.amexnetwork.com

Leslie, Rockville MD shares her experience about getting extra rewards with American Express offer:

“I just bought a Mercedes and the dealership confirmed they had a deal with AMEX that would allow me to put the entire purchase price on AMEX. I switched my AMEX Platinum to the Mercedes Benz Platinum AMEX and I got 5 points per dollar. I ended up with 250k points on my rewards account! ”

Is it legal for dealership to decline a card?

We are so used to pay for everything with our credit cards that we often feel it is weird and even illegal when dealerships limit a credit card payment options. Luckily, this point of view is supported by the biggest credit card payment systems. VISA spokesperson said on that matter:

"U.S. merchants must follow basic card acceptance rules for all Visa transactions. Visa's rules do not allow merchants to impose a maximum transaction amount as a condition for honoring a Visa card. Our rules require merchants to always honor valid Visa cards regardless of purchase amount -- large or small."

Many experts agree that dealerships are not allowed to limit a maximum transaction amount or add extra fees. For a customer it is still very difficult to withstand them:

“Technically, they violate credit card agreement that says that there is no min or max limit (other than the customer’s credit limit). In spite of dealership policy, they cannot impose any limit or add extra fees towards credit card payments. It’s just one of those things that for the individual is too tough of a fight. As often is the case being right in an argument doesn't mean you will win.” - Brian, bank employee from Arlington, VA says.

Credit card vs auto loan

Generally, credit card APR is substantially higher than the auto loan APR - average car loan APR in US is 5-6% vs. 15% average credit card APR. Well, why so many people still want to finance a vehicle purchase with a credit card? There are many real life examples when a credit card purchase is more beneficial. Let’s have a look at the pros and cons of both options:

- Credit card purchase is unsecured unlike the auto loan. That means your car will not be repossessed by the bank even if you fail to make a few monthly payments. You can also save several bucks on mandatory car insurance.

- With a credit card, you have more flexibility in monthly payments. You can pay as low as 5% or pay in full right away without any penalties.

- Average car loan interest currently is 5-6%, recent research shows. With a credit card, you can use a 0% introductory APR offer and have 12-18 month free of interest.

- With auto loan, you are waiting for a bank decision and paperwork while with a credit card you can close the deal immediately.

- Sometimes even rather expensive cash advance option can save you money compared to an auto loan.

Matt, financial blogger shares his positive experience and some simple math:

“We put our most recent car purchase on a credit card. Our Craigslist special 2001 Suburban for $6200 from a private party seller. It was very easy to go to the credit union and get a cashiers check with the funds drawn from our credit card. A one-time fee of $5! Our interest rate on our credit card is locked at 5.9%, which is the same rate they were offering on auto loans for a car that old. After we sold our 1999 Durango, we put the proceeds back on the card. So, we essentially only financed the difference. By using the credit card funds rather than an auto loan, we didn’t have to fool with the bank putting a lien on the title and requiring what they think is sufficient insurance. I plan to do future car purchases this exact same way if I don’t have enough cash to pay the entire purchase price up front.”

The main downside here is that there is a risk that your credit score will go down temporarily after such a big purchase. You use most of your credit card limit, thus increasing your debt utilization ratio. That makes it hard for you to get another loan or credit limit in the short term.

Oh, and rewards

The main reason of putting everything on the card is the rewards - miles, points or cash back can be a sweet bonus to a new car.

If you have enough cash and do not need financing, things are even better - you can stay within the grace period and earn additional rewards.

A best-case scenario with 2% cash back will bring you extra $100 for every $5,000 of your spending. You can also combine it with sweet card’s introductory offers:

“I just purchased a new electric Prius. The price for the new car was pretty standard, as it was an electric and not too many dealerships around. The broker was able to negotiate (since very little of the transaction was negotiable) $9,000 on my credit card. This was the bomb because I just received my British Airways Visa for which I can earn free companion tickets of any class with a year's expenditure of $30K on the card. The $9,000 went a long way! They did not charge me a fee for the use of the card and I had shopped around a lot, and felt that they gave me the best deal, sans use of the card, so the 9,000 felt like a great bonus.”

Sometimes it still makes sense for you to use a card, even if a dealer imposes an additional 3% transaction fee (though it is illegal according to CC agreement). Meggie and Jonathan saved $690 using a cash back credit card:

“Recently we managed to buy a $27,000 Chevy Impala entirely on a credit card. The dealer put the first $5,000 at the credit card with no fee and we agreed to pay 3% of the rest to cover the fees. The salesperson was surprised that we agreed to pay these and thought we did not know what we were doing! However, I used my credit card with temporary 5% cash back offer and earned extra 2% out of $22,000. We ended up with extra $690.”

A few final tips how to handle a large purchase on the card:

- Check your credit limit first. If necessary, you can ask the bank to increase your limit.

- Leave a note to your bank about your plans, so they don’t block the unusual activity on the card.

- Double check if there is a cap on a cash back or miles you can earn within the period.

Leave a comment

CREDIT SCORE UPDATES

exclusive members-only deals