Debitize: Use a Credit Card Like a Debit Card

While credit cards can offer all sorts of perks, there’s a real risk in making purchases on credit. It can be hard to stay restrained from spending more money than you have, and over time you could find yourself buried in high-interest credit card debt.

Many people turn to debit as a safer alternative. You make a purchase, the money comes out of your account, and you know exactly how much you have left afterward. But what if you could get the perks that come from using a credit card without having to worry about having enough money in your checking account to pay the bill?

Debitize makes that a possibility, which is why I was excited to discuss the company and service with its founder, Liran Amrany.

Louis DeNicola: Can you explain what Debitize is and talk about the origin of the company?

Liran Amrany: I started Debitize in the middle of 2014 and brought Jeff Hu, our chief technology officer, on board in September of 2015.

At the time, I was working in finance and two friends told me they were switching from credit to debit. That didn't make sense to me. They were basically paying hundreds of dollars a year in the form of missed rewards just to have the money come out of their account every day.

If you're using debit you aren’t earning rewards, building credit, or getting the security fraud protection of a credit card. The only reason to use debit, is if you like the discipline of paying for your purchases right away.

What we're trying to do with Debitize is automate good financial habits. We’re effectively letting you use a credit card like a debit card. So, you get all the benefits of a credit card without the risks.

We're starting with credit card spending because it's a big problem that we see in two ways:

- People easily lose track of their spending on credit cards.

- People avoid credit cards altogether.

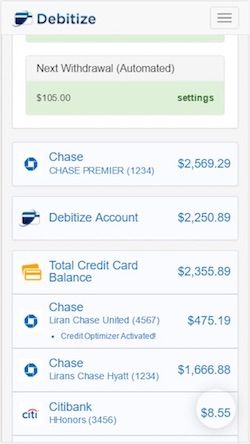

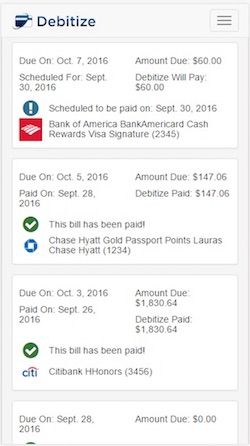

Debitize works in the background every time you use your credit card. When you make a purchase, we'll automatically withdraw funds from your checking account to cover the full amount of that purchase. At the end of the month, we automatically pay the bill for you with the money that’s set aside.

Today, we have users who are earning an extra fifty or hundred dollars each month because of the service.

Has the company done well since you started in 2014?

It was a slow start because it was basically just me for the first year. I hired a development shop and built out an early version of the product where we were moving money using Venmo. Eventually, we were able to expand beyond that and automate the payments.

Then Jeff came on board, and in April of this year we opened up the platform and let anybody sign up. Before that, it was by invite only.

There's still a lot of work to do. We're working on a mobile app and making tons of improvements both to the functionality and the user interface of the site. We're excited for what's coming because I think a lot of people could benefit from it.

The big question for every startup, how do you make money?

We have three primary revenue streams.

- Interest on funds that are sitting in our users' Debitize accounts.

- Affiliate marketing, such as targeted offers for credit cards and other products.

- Premium features, such as the credit optimizer tool. We also have some things around credit repair that might have a fee

What’s the process for someone who’s new to Debitize.com? What do they need to sign up?

You start by creating an account on Debitize.com, then you can connect any number of credit cards using your credit card login credentials and link your checking account.

Because we're moving money and holding money on your behalf, we have to do a little bit of what's called KYC, know your customer, for regulatory reasons. You’ll need to share the last four digits of your Social Security number, your birth date, address, and phone number.

How is the user’s information kept secure?

We're working with a company called Plaid to connect to your bank account. They are the same company that Venmo, Betterment, Acorns, and many others use. Security is what they do.

Debitize doesn’t store your credentials at all. As soon as you enter them into your Debitize account we pass them straight through to Plaid. Then Plaid basically gives us a token that lets us refresh your accounts and balances for you.

What if someone spends more money on their credit card than they have in their checking account?

Debitize won't overdraft you. We let you set a minimum balance for your checking account, and won't take out money once you reach that minimum balance. You’ll also receive notifications so you're aware that you’re spending more money than you have.

When you do get the funds, we'll take them out to cover your balance. If you don't have the money at the end of the month, then you’ll be carrying a balance on your credit card. We'll pay what we can, and try to keep you aware of your spending. But it’s not like your card will get declined at the register.

What if someone doesn’t want to fully pay off their credit card at the end of the month?

You can carry a balance on a card if you can’t or don’t want to pay off the whole thing. When you first connect a card, we ask if you want to pay off the whole thing or not. For whatever reason, say you have a zero APR card, you could want to make minimum payments for a while and we let you do that.

We also have a feature where we will automatically pay your balance down a certain amount per month. If you're coming into Debitize with $5,000 worth of credit card debt and you want to cover all your future purchases, plus you want to pay off an extra $500 a month so you can be out of debt in ten months, we can do that for you automatically.

Have you seen people using this feature to pay off their credit card debt?

Absolutely. It's not the use case we're focused on right now, but we have several people that have come in with a few thousand dollars of credit card debt and are in various stages of paying it off. A couple paid off the full amount; others are close to paying it off.

You mentioned increasing credit scores as one reason why someone might want to use a credit card. Does Debitize help people build their credit?

There is a credit optimizer feature that people can use to improve their credit. In addition to making sure that you pay your bills on time every time, which is the biggest and most important thing you can do for your credit score, we're also optimizing your utilization, which is the second largest component of your credit score.

We do that by paying you down to one percent of your credit line right before the bank reports to the credit bureaus. Then we'll pay off the remaining balance on the due date. The idea is to lower the balance the issuer reports, which can help your credit. Credit optimizer is free on one card right now and will be available on more than one card for a fee in the future.

Are there other features or benefits that you want to build in the coming year?

The first thing we're focused on is launching a native mobile app in the first quarter of 2017. That's been a big request from our users. We're also going to try to let users set aside the money sooner instead of waiting for the transactions to post to your credit card. After that, there are some minor cosmetic improvements to the way Debitize works and how people interact with it.

We also want to start building tools to help people pay down their student loans, mortgage, rent, and any other big monthly expense. We want to help you optimize the way you pay those down and get you out of debt the fastest, cheapest way possible.

The long-term goal for us is to take a lot of the anxiety out of managing your finances. We won’t just give you advice – we want to do it for you.

Leave a comment

CREDIT SCORE UPDATES

exclusive members-only deals