Best Options for Free Credit Score and Credit Report

If you are trying to build your credit, you need to access your credit score regularly and get a credit report from time to time – best if free of course. This way, you can see exactly what is going on with your credit situation so you can address issues that need to be taken care of and you can watch how your efforts affect your score.

In many cases, consumers don’t always really know what’s on their credit report until they see it. It’s easy enough to forget about old bills, but there are also cases of credit fraud that involve other people using your name and credit to purchase goods and even get cash in hand.

In fact, according to the Federal Trade Commission, as many as 21 percent of American consumers have found an error or mistake on one or all of their credit reports.

These errors can make a huge difference in whether or not you are approved or denied the next time you apply for a credit card.

To ensure you stay on top of your finances, here are several ways to track and monitor your credit, as well as some of the places you can get your credit score and credit reports.

Get Your Free Government-provided Credit Report

The Fair Credit Reporting Act was put in place so that consumers could have the ability to see what was on their credit report once a year without paying for the service. The three credit bureaus, Equifax, Experian, and Transunion all use the same government-provided online service to offer these reports. AnnualCreditReport.com offers you to see your credit report once a year after you request it. For many consumers, this is the easiest and the best free credit report to get, simply because you can access them quickly right from your laptop.

However, what happens when you need more frequent updates or you want to make sure something was reported correctly, but you don’t have a year to wait for your next free report? Well, there are a couple of different ways you can get your credit score or your credit reports quickly and easily.

FICO, Vantage and Other Credit Scores

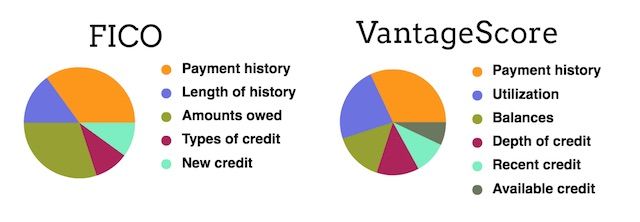

Although your credit score is calculated in a number of ways by different companies, the FICO score is the score that is most often used by lenders when determining your ability to repay loans. It was introduced more than 25 years ago by Fair Isaac Corp. and uses a proprietary and constantly evolving algorithm to calculate your creditworthiness.

FICO is still the main score used by the lenders, and it is important to know where you stand on the FICO scale

In 2006 three major credit bureaus introduced an alternative formula that they designed in collaboration and called VantageScore.

Both FICO and VantageScore formulas can be used on the data from three major credit bureaus to get a number that represents a person’s credit worthiness.

It gets even more complicated with many revisions (versions) of both formulas in use and the fact that even same FICO score has several versions for different applications - General, Auto, Mortgage, Credit Card, Installment loan and Personal finance. Every person has many dozens of slightly different credit scores, and it is hard to predict which one is used by a particular lender for a particular product.

However, because all scoring methods are often pretty close to your actual FICO score, it makes sense using either score for monitoring and education. As long as you have your credit reports on hand and you have an idea of what your credit score is, you can work on correcting anything that might be bringing you down.

Main differences between FICO and VantageScore are in the following areas:

- Paid-off collections FICO is counting them in the score (but newest FICO version starts discounting them), VantageScore disregards them in calculations.

- Use of alternative data (rent, utility, etc.). It is used in Vantage Score and not used in traditional FICO.

- Minimum length of credit to have a score. It is 30 days for VantageScore and 6 months for FICO.

You can sign for credit monitoring services at myFICO.com which is a consumer division of FICO. It is not free and prices start at $19.95/month and are up to $59.85/month. One time reports costs the same as the one-month subscription.

Free Credit Monitoring Services

There are plenty of credit monitoring sites that allow you to track your progress or lack of progress when it comes to your credit and credit reports for free. They aren’t usually 100% similar to FICO, simply because many use different scoring methods other than FICO, but they do give you a pretty good idea of the activity that is going on with your credit report. That is to say that your actual credit score may not always be accurate, but regardless of the scoring method used, they all give you an approximate idea of where you stand credit-wise. All major credit monitoring services use variations of VantageScore models.

Some of the most prominent are:

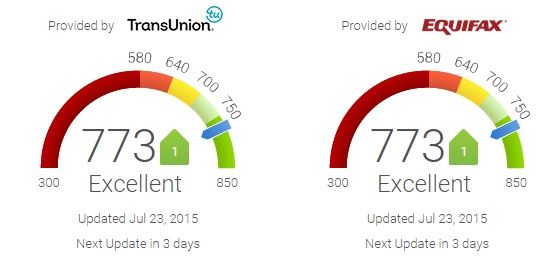

- Credit Carma that offers VantageScore 3.0 scoring model by TransUnion and Equifax

- Credit Sesame uses Experian National Equivalency Score wich is similar to Vantage score 3.0

- Quizzle uses VantageScore

-

WalletHub is the first and only service that offers daily updated credit monitoring and free full credit report. They use Vantage 3.0 score through TransUnion (300-850 scale).

Main advantages of WalletHub are daily credit monitoring (can be useful in situations when you track your score closely) and a free full credit report from TransUnion.

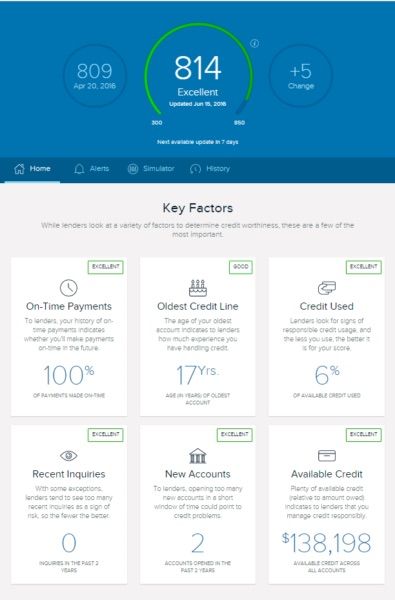

These services provide value to users by offering credit monitoring solutions, alerts, credit score simulators and credit education.

How do they make money with free services? Simply by offering you credit products that fit your credit score – credit cards, loans, etc.

There is also a great number of “Free credit monitoring services” that are in a shady business of subscribing you for a “free” credit monitoring. They provide you with a free service for the first month, then set up recurring charges on your credit card and keep charging you until you find it out in your credit card report and cancel. Its better to avoid these companies, they do not offer any value in comparison to official sources.

Free credit score from your bank

With the recent push from the Consumer Finance Protection Bureau, credit score providers made possible for the banks to share a credit score with the end user for free.

Today more and more banks are ready to disclose credit score information to their clients.

Banks offering free credit scores to non-clients

- Discover – free credit score from TransUnion. Available online and in monthly statements to credit card clients.

And it is one of the first banks that started offering free FICO score in the credit scorecard to non-clients. Just log on the website and get your Trans Union FICO score for free!

- Capital One bank is offering a CreditWise product to its customers, which is a non-FICO score, based on VantageScore 3.0.

CreditWise is a useful tool, similar to offerings like CreditCarma or CreditSesame – with alerts, score simulators, in-depth view on the credit score factors. What is even better – it is available for free to non-customers also.

Free credit scores for clients only

- Citi offers Equifax FICO credit score to its credit card clients.

- Chase offers free Experian FICO credit score for Chase Slate cardholders.

- BankofAmerica discloses FICO credit score from TransUnion to all of its clients. It also offers text alerts on your credit score changes.

- Commerce Bank offers free FICO score to cardholders

- AmericanExpress offers free FICO score to its clients.

- Ally Bank offers free credit score to its auto loan clients.

- Walmart credit card comes with a free credit score if you participate in electronic statements.

- US Bank - Experian FICO score is available to US bank cardholders.

- USAA offers 2 levels of service to its members – free and paid. Credit score is based on non-FICO Experian VantageScore 3.0.

- First Bankcard - free FICO credit score monitoring for cardholders.

- Wells Fargo - free FICO score to its cardholders.

- PenFed offers free credit score to members with active credit card, loans or checking accounts.

- Synchrony bank offers free FICO score to cardholders on some credit cards.

- Credit One Bank offers free monthly credit tracking to the cardholders.

Making the Most of Rejection

You’ve applied for credit and been denied, but you can’t figure out why. You’ve been working hard to improve your credit score, and you were sure you would be approved. What’s the holdup? Well, although being denied can be frustrating, it provides another easy way to get a free credit report. When you are denied credit – no matter the reason – lenders and credit card issuers don’t have to explain why or give you a reason right away. However, if you request a reason for the rejection, they have to provide it at no expense to you.

Unfortunately, even with a free credit report, you can look at the information all day long, and there’s a chance you still won’t figure out exactly what is stopping you from being able to open a line of credit with a particular lender. Sometimes, it has nothing to do with your credit score at all. Some of the many reasons your application may have been rejected include but are not limited to the following.

- Not enough existing credit

- Too many open lines of credit

- Using too much available credit

- Too many inquiries into your credit

- Accounts in arrears within the past 90 days

These are just some examples of the reasons your application might be denied. It’s really up to the lender or company that is offering the credit. So, if you missed one payment in the past 30 days, but made all of your other payments on time, they might choose to reject you. Whether you are approved or denied by a lender is often based on their own requirements. Some companies don’t even look at credit reports, but offer you a limited line of credit in their store and base credit limit increases, rejections, and decreases on how you manage your line of credit with them as opposed to how you manage it in general.

The point is that asking for reports like these can help you fine tune your credit for specific places, which is naturally going to help your credit overall. You may have thought your credit score wasn’t high enough, only to find out that you were using too much or not enough of your credit. When you tweak specific areas, it impacts your credit rating as a whole, so the information is still useful to you.

Can credit report affect my score?

If you keep getting rejected, and continue to ask new lenders for credit, you could be lowering your own credit score without even using your credit. There are two types of inquiries that you need to know about.

Hard Inquiry: When you apply for credit and give your permission to the lender to check your credit report, this is known as a hard inquiry. It takes points off your credit score, but it is also recorded so other lenders who look at your report can see that you have applied for credit with a particular lender.

Soft Inquiry: A soft inquiry doesn’t require your permission, and because of that, it doesn’t take points off your credit score. In many cases, these are not conducted in an effort to determine whether or not you are worthy of a loan of some sort but could be used for other instances such as advertising and marketing efforts. Any of the creditors you currently have an account with might check your credit through a soft inquiry to determine if you qualify for increased credit or other products.

The good news is that when you are checking your credit score or a credit report it is a soft pull on your credit file and doesn’t affect your score.

Knowing how to get your credit score is just the start, but having an idea of the where to get the best free credit report is the next step because it gives you more than a number. Combine all of the available information you have and address all elements of your credit worthiness by keeping your payments current, disputing claims you don’t remember, and limiting your use of credit available to you.

Leave a comment

CREDIT SCORE UPDATES

exclusive members-only deals