Get Credit Without the Credit Inquiry with the Shopping Cart Trick

Whether you are working on improving your credit or just maintaining the good credit you already have, it’s important to be mindful of, even small actions, that can potentially damage your credit score. Some of these actions might only affect your score by a couple of points for a short period of time, but there are instances, such as being right on the line between good and excellent credit, that every point counts.

One of the ways your credit can decrease is through multiple credit inquiries, also referred to as “hard pulls". So what do you do if you want to take advantage of a store’s rewards program or its credit card’s sign-up offer? There is something known as the “shopping cart trick” which can allow you to apply for a store card without a hard credit inquiry. With this trick, you can get a store credit card and participate in any new cardholder offers, without worrying if the inquiry will decrease your credit score.

What is the Shopping Cart Trick?

The shopping cart trick is simply a way to apply for a store credit card without getting a hard inquiry on your credit report when you apply. This is especially ideal for shoppers who can’t afford the potential loss of points from the credit check, or for those who already have bad credit and aren’t sure if you’ll qualify for the card. It can be seen as sort of a prequalification measure that doesn’t affect your credit score.

It’s important to note that the shopping cart trick only works for store credit cards issued by Comenity bank, as well as some issued by Synchrony and Wells Fargo.

But, for the most part, these are the primary issuers of store credit cards anyway.

no fees

Up to $5,000 Spending Limit in Less than 60 Seconds! Shop from over 100,000 brand name products such as Apple, Samsung, Sony, Gucci, Prada and much more with low easy payments.

Less than Perfect Credit Accepted. Approval is quick and easy. Must be 18 years or older, have a valid checking account and a verifiable source of income.

How to Do the Shopping Cart Trick?

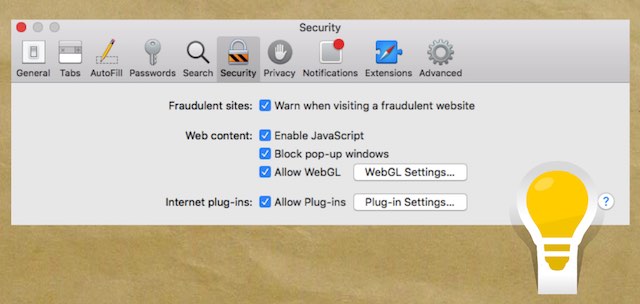

To do this trick, you’ll need to make sure you are opted in for credit card promotional emails, which is usually everyone’s default. Also, make sure you have your popup blocker off if you use one, otherwise you could miss out on a credit card promotional offer. Otherwise, you are ready to use the shopping trick.

1. Go to the store’s website. For instance, if you want the Walmart card, you would need to go to Walmart.com or VictoriasSecret.com

2. Join the loyalty program. You can also skip this step and checkout as a guest if you choose.

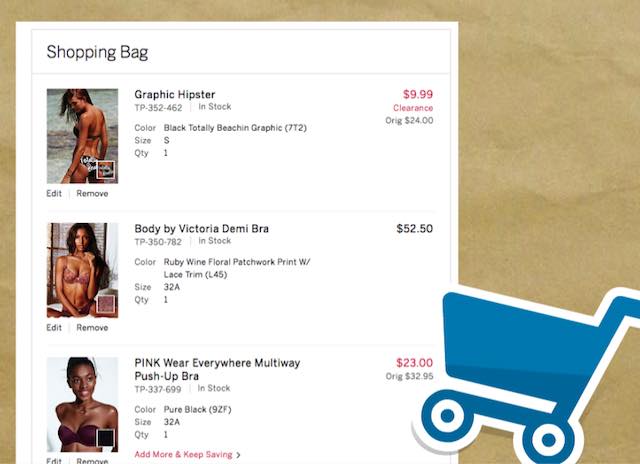

3. Add items to your shopping cart.

3. Begin the checkout process by entering your address. Be sure it matches the address on your credit reports.

4. You should get the credit card offer before you reach the final payment page. Just accept the card offer and apply for the card.

5. If you didn't get the offer, the trick hasn’t worked, and you should try again. Possibly, popups are blocked in your browser - turn it off to get the offer.

Where Can I Use the Shopping Cart Trick?

Some of the stores and cards you can apply online with using this trick include but are not limited to the following:

- Abercrombie & Fitch

- Ann Taylor MasterCard

- Buckle

- Chadwick’s

- David’s Bridal

- Dental First Financing

- Eddie Bauer

- Express

- Fashion Bug

- GameStop

- Gander Mountain

- Gordman’s

- Home Shopping Network (HSN)

- Justice

- Lane Bryant

- The Limited

- LOFT

- MyPoints Visa

- Pottery Barn

- Sports Authority

- The Sportsman’s Guide Visa

- Total Rewards Visa

- Victoria’s Secret

- Virgin America Visa

There are many other popular retailers such as Walmart that allow you to use this trick, so if you aren’t sure, it’s best to try it out, especially if it’s a Synchrony or Comenity store card.

Read more about our other popular department store credit cards here.

How this Trick Can Help You

The shopping card trick is helpful not only because it lets you apply for store cards without a hard pull on your credit report, but it can also be helpful in other ways. For instance, store cards are generally easier to qualify for if you have bad credit or credit problems in the past. By using the shopping cart trick, you can see if you apply for the card without racking up harmful credit inquiries, and when you get the card, you can start rebuilding your credit. Further, because there isn’t a hard pull, the creditor isn’t able to see things like bankruptcies, and if they are able to see accounts by other retailers, they are more likely to approve your account.

Also, stores and credit cards typically offer valuable sign-up bonuses or discounts for new cardholders and customers. You can end up saving money or getting a financing offer that can result in a savings of hundreds of dollars.

Important Notes to Keep in Mind

- Although it won’t result in a hard inquiry on your credit report the card and your account activity will affect your score when reported to the credit bureaus. As long as you make your payments on time and follow the credit card guidelines, the card can actually end up helping you improve your credit over time.

- Most of the time, you’ll have to enter the last four numbers of your Social Security number. If you are asked for your entire SSN, it is likely going to result in a hard pull on your credit. This is important to keep your eye on if you don’t want a hard inquiry.

- Make sure you enter the information as it appears on your credit report. You won’t get a hard inquiry but this trick does result in a soft inquiry so your personal information needs to match.

- You don’t have to purchase anything for this trick to work, even though you have added items to your shopping cart. Once you have applied for the card, you’ll be sent back to the checkout page to either complete your order to cancel it.

- Don’t expect a high credit limit. Store credit cards often only provide lower limits around $500, but you can usually get an increase over time.

- If you don’t get the credit card offer before you reach the final page of checkout, you can try to start over again. There have been instances where consumers have been able to refresh the website, begin again, and get the credit card offer to come up.

- Promotional offers change over time. You may come across a store that no longer allows this trick, or you could encounter a store that no one else knows allows it. If you aren’t sure, it doesn’t hurt to try it out and see. Keep in mind, however, that if you are asked for your entire Social Security number, it will most likely result in a hard pull and affect your credit score.

- This trick doesn’t guarantee approval, although you have a better chance of approval with store cards and using this method. Here are some other options for credit cards if you have bad credit and are rebuilding.

Heres's a video instruction how to do a shopping cart trick.

Image by Izee

Comments

TIa, 08/31/16

Leave a comment

CREDIT SCORE UPDATES

exclusive members-only deals