What Happens When a 0% Intro APR Period Ends?

One of the most common promotions credit card issuers offer to entice new cardholders is a 0% introductory APR period. This allows you to save money on interest when you make use your card for either purchases or balance transfers, or sometimes both. Although this is a significant money-saving promotion that could potentially save you hundreds of dollars, it’s important to be aware of how a 0% intro APR works and what happens when the 0% intro APR period ends.

What Is a 0% Intro APR?

A 0% introductory APR period is a promotional tool that card issuers offer new cardholders, which allows you to save money on interest when you use their card for purchases and balance transfers for a certain period of time. This 0% interest period can be anywhere from 6 months to a couple of years or more, depending on the card. When you use your card during the promotional period, you have an opportunity to pay down your balance within a certain amount of time at 0% interest, which can save you a great deal of money, especially if you haven’t always been diligent about paying your balances in full every month.

After the 0% Introductory Period Ends

If you choose to take advantage of a 0% introductory APR, it’s important that you consider whether or not you will be able to pay down your balance within the promotional period. After the intro period, whether it’s for 6 months or a couple of years, your balance will begin to accrue interest at the rate you are given by the credit card issuer. This means that if your regular purchase and balance transfer APR for the card is 16%, this is the rate that will be applied after your intro period. When it comes to keeping debt low and transferring balances to save on interest, you have to pay off the balance in full during the 0% period in order to get the most value and savings out of the offer.

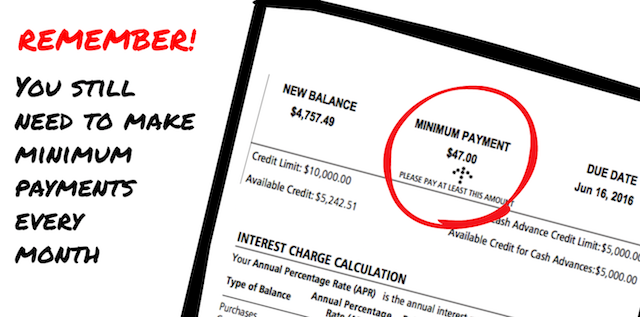

You still need to make at least minimum payments during the intro APR period

Credit Offers with Deferred interest

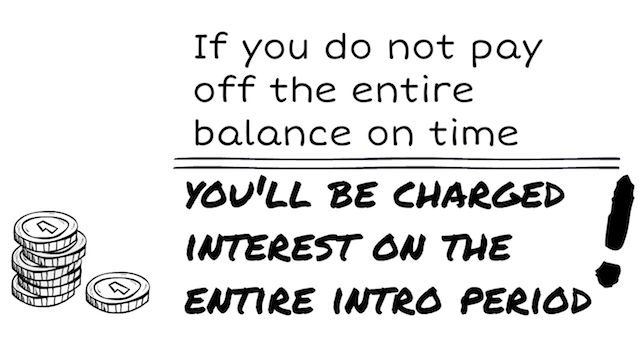

Some credit cards offer deferred interest plans - most store cards have these offers during the holiday season. When you see a marketing text that looks like "No interest if paid in full in XX month" - be aware this is a deferred interest offer.

The problem with deferred interest is that if you do not pay off the full balance on time, or miss a payment, you will owe backdated interest for the whole introductory period.

Payment allocation on a credit card with balances with different APR's make the process very confusing for a customer.

Understanding Payment Allocation on a Credit Card

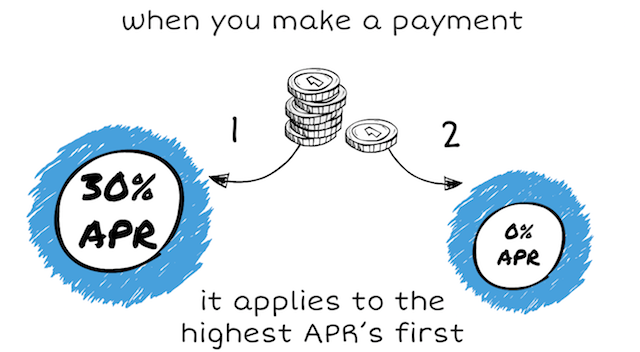

Introductory APR periods also add a lot of confusion to the way the credit card payment is distributed between balances with different APRs.

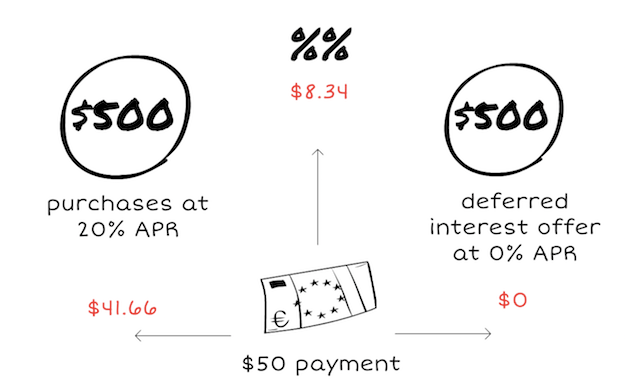

For example, you have a balance with an introductory APR and a balance with a regular APR on the same card. Let's assume it is $500 balance with a 0% APR and $500 balance with regular 20% purchase APR.

When you make a payment more than a required minimum, it applies to the highest APR's first.

In our example, if you make a payment larger than a minimum payment, the excess money goes towards balance with the highest APR first. It is the requirement of the Credit Card Act of 2009.

So, out of the $50 payment, $8.34 goes towards interest, $41.66 goes towards balance with a 20% purchase APR, and nothing goes towards your balance with 0% deferred APR.

This means that you will not start paying off your 0% APR until your balances with higher APRs are not paid off.

This situation can be dangerous if you are not prepared to pay off the balance with deferred interest before the last day of the introductory period. After that, you will be charged a large interest on the whole intro balance from the beginning of the introductory period.

Choosing a 0% Intro APR Credit Card

Because 0% introductory APR offers are such significant opportunities for saving money and paying down debt, the right credit card can be a useful tool for your finances. Before selecting a credit card with a 0% intro APR, here are some things you should consider.

- Can you pay the balance off in full before the introductory period ends?

- Are there any other fees such as balance transfer fees?

- Will the fees cost you more even without paying interest?

- How high is the APR after the intro period?

- How much will a 0% introductory APR cost you in the end?

If you have decided that a credit card with a 0% intro APR can help you save money and gain control of your outstanding balances on cards with higher APRs, there are many cards you can choose from. However, here are our recommendations for the best 0% introductory APR credit cards.

Best 0% Intro APR for Balance Transfers

One of the best ways to pay down debt and save money is to transfer a balance from a credit card with a high APR to a card with a 0% intro APR on balance transfers. However, many balance transfer cards charge fees of, at least, 3% of the balance transferred, so you will need to calculate how much you will actually save before you make the decision to transfer your balance.

This card is well-known for its rewards program which allows you to earn as much as 5% cash back in quarterly rotating categories. The Discover it card also offers a 0% introductory APR on balance transfers for 18 months, which is one of the longest 0% periods for balance transfers available. It also offers 0% intro APR for purchases, but only for 6 months. After the intro period, the APR will be a variable APR of 11.24% to 23.24%. There is also no annual fee for this card.

Bank of America’s BankAmericard Credit Card is also one of the best balance transfer cards, offering 0% intro APR for 18 billing cycles. The 0% APR applies to balance transfers made within the first 60 days. After that, a variable APR of 11.24%-21.24% will apply. There is no annual fee for this card.

no annual fee

0% intro APR on purchases and balance transfers

0% BT fee for 60 days

free FICO score

The Chase Slate card is often considered one of the best balance transfer credit cards because it offers a 0% intro APR for 15 months on balance transfers and purchases. After that, the APR is 13.24%-23.24%. This card stands out from the others, however, because there is also no balance transfer fee if you transfer a balance within the first 60 days of opening your account. After that, the fee will be 5% of the transfer or $5, whichever is greater.

Best 0% Intro APR for Purchases

If you don’t need to transfer a balance from another card, but you are planning a large purchase or vacation right away, you should instead choose a credit card with a 0% introductory APR on purchases. These cards provide an opportunity to make your purchase and pay it down within a specific amount of time, without paying interest on your purchase.

This card from Bank of America offers 0% intro APR for both purchases and balance transfers for 12 billing cycles. After that, a variable APR of 13.24%-23.24%. You can also earn 3% cash back for gas purchases and 2% cash back at grocery stores and warehouse clubs, up to a limit of $2,500 in combined purchases each quarter. All other purchases earn 1% cash back. Plus, if you are a Bank of America customer, you can earn an additional 10% bonus when you redeem your rewards into your Bank of America checking or savings account.

The Citi Simplicity card is a popular low-interest credit card offering 0% intro APR for 21 months on purchases and balance transfers. After the intro period, a variable APR of 13.24%-23.24% will apply. This card does not have any late fees or penalty rates, which many card users find beneficial.

Many low-interest cards require excellent credit, but if you have a lower credit rating you might qualify for the Capital One Quicksilver Cash Rewards card. This card offers 0% intro APR on purchases and balance transfers for 9 months. After that, the APR will be 13.24%-23.24%. You also get 1.5% cash back on every purchase you make with the card. Although this is a shorter 0% period, you may still be able to save money on purchases and balance transfers with this card, even if you don’t have credit established or if you have had minor credit problems in the past.

You can read more about low-interest credit cards in this article.

Leave a comment

CREDIT SCORE UPDATES

exclusive members-only deals