Due Helps Freelancers and Small Business Owners Get Paid On Time

While everyone looks forward to getting paid for their work, the administrative task of creating, sending, and tracking invoices can sometimes be a pain. In 2015, Due released an online invoicing platform that helped simplify the entire process. Since then, they’ve expanded to offer a range of payment-related services, including merchant services and global online payments.

We spoke to John Rampton, CEO and founder of Due, about the company’s invoicing platform, how you can help ensure on-time payment, and the company’s future.

Louis DeNicola: So, if we can start? Just tell me a little bit about yourself and the inspiration for Due, how the company came about.

John Rampton: My name is John Rampton. I'm an entrepreneur. I’ve been an entrepreneur my whole life. I blog a lot, and I write for lots of big places, like Entrepreneur Magazine and Forbes Inc.

I've owned a digital agency for a couple of years, and when I was building that digital agency, we had hundreds of contractors every single month. I found out that paying people is still really hard. We were really frustrated with this, so we went and built a new platform that worked for us. And it worked very, very well for us.

So we started using the invoicing and tracking system with all the people that worked with us, and they liked it. All of the sudden, they started using it with other companies and then other companies signed up and started using it. We took that invoicing product and the business became what it is today. We are a payments company that makes it easier for people to get paid.

How is Due different than another invoicing platform and why can't someone just use PayPal, a Word document, or a PDF and send if off to clients?

PDF, Word, and Excel are probably our arch nemeses and biggest competitors. But I wouldn't say we're similar because we're also a tracking system. We don’t just send out a professional-looking invoice — you can also automate things. If you have a monthly client, you can automatically set it up, so you don't forget.

PDF, Word, and Excel are probably our arch nemeses and biggest competitors. But I wouldn't say we're similar because we're also a tracking system. We don’t just send out a professional-looking invoice — you can also automate things. If you have a monthly client, you can automatically set it up, so you don't forget.

We researched a lot of the science behind why people don't pay and the number one thing, why people don't pay, is because of inconsistency. If you don’t bill at the same time every month, if they that don’t look the same, or if you use different forms. A lot of things throw businesses off and cause bills not to be paid.

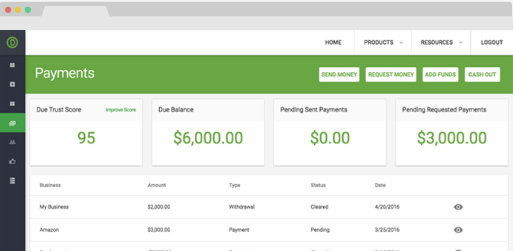

Then you can connect your PayPal account or use our credit card services to receive payments. PayPal charges their own fees — we just provide the connection. We charge flat 2.8 percent fee for the credit card processing.

The whole invoicing and tracking system is 100 percent free.

We don't charge anything. The only way we make money is if you enable payments and enable credit card processing.

Does Due integrate with other software to help people track their finances?

We integrate with QuickBooks, Stripe, and several other companies. We work with some businesses that we call our frenemies.

We basically want to create the best and simplest system in the world to bill and get paid.

And if you’re using our payment processor too, that’s awesome. If it's not using us, just the same. You're getting paid and that's our goal.

Whether someone is using Due or sending invoices on their own, do you have any tips for helping people get paid on time?

Yeah, there are a lot of things you can do. We put together an in-depth guide how to get paid based on data we collected from 250,000 invoices. We literally detail out every step, and we have a lot of data to back up those tips.

One example is putting a logo on an invoice. We found having a logo on your invoice will increase your chances of getting paid on time by three times. It makes you look more professional and it legitimizes your business. That's a huge one that I think a lot of people don't really get.

The number one thing, why people don't pay, is because of inconsistency

I would say the next one is invoicing at the same time every single month. Also, we found that people are a lot more likely to get paid if they put a due date on their invoice. A lot of people, especially when they’re sending an invoice via PDF or something like that, forget. That's huge because companies will think they can pay it whenever.

Some people create PDFs and the invoices look different every single month. A lot of companies manually import the information, and if it looks different, that could typically cause a three- to five-day delay.

Also, a lot of people just say here's a bill and then they don't tell the company how to pay them. Make sure you have a way to get paid and specify how you want to get paid, whether it’s PayPal, a bank transfer, or a check.

It's little things that a lot of people don't really think about but can actually be a big deal.

What happens if you use Due and a client doesn't pay an invoice on time?

When a person does not pay the bill on time, we send them reminders until they pay. You can set that up, so it will send them a daily, a weekly, or a monthly reminder. If you really want to go the extra route, we have some educational, legal resources you can review.

Due used to have some membership plans, why did that change?

We originally were using a FreshBooks model, or something like that, and we had a lot of paying customers. But we were making great money on the payments, so we decided to just get the word out there by offering the rest of the service for free. We also found that people were a lot more likely to sign up and use our service if it was free.

Can you touch on a few of Due’s other products?

Invoicing and payments we’ve got covered. We also offer merchant services with the same 2.8-percent fee.

Invoicing and payments we’ve got covered. We also offer merchant services with the same 2.8-percent fee.

eCash is a product that we're building out right now. It's currently in beta. It basically allows you to send money via a digital wallet from person-to-person for free. If I wanted to, I could pay you $2,200, and it would be in your bank account tomorrow.

It would just pull out of my bank account and push it into your bank account and that product is 100 percent free.

Is the focus of the company now on eCash?

For sure. The invoicing is all built. It works great and our customers love it. We're more focused on the payments, building out additional features, and stuff like that.

Is there anything else you’d like to share?

One thing is that we're focused a lot on content. So we put out a lot of resources for our fans and our customers. We find that the more we help people out, the more they come back to us and use our product and service. So we're just trying to provide the best service out there and lots of good information to help them grow their businesses.

Leave a comment

CREDIT SCORE UPDATES

exclusive members-only deals