College life is a transition for young adults just out of...

All Things You Need to Know about Metal Credit Cards

Usually, you probably don’t pay much attention to the type of card someone is using at checkout. Unless, of course, you notice that their card is shinier than most and appears to be made of something more luxurious than the typical plastic. These cards are referred to as “metal credit cards” and often exude a sense of style and prestige.

But do these cards offer anything different from other cards, or do they just look fancy and special? Although there are many quality credit cards to choose from, specialty metal credit cards often provide elevated perks and rewards. Some of the features that come with these cards can end up being worth hundreds – or even thousands – of dollars in perks and extra benefits. Here’s what you should know about metal credit cards and what they can be worth to you.

The Best Metal Credit Cards

Some of the most popular metal credit cards include the following cards:

$85 annual fee, waived for the first year

80,000 sign up bonus

5x points on Marriott

2x points on airlines, rental cars, dining out

The Marriott Rewards Premier card not only looks great but it also comes with many perks that travelers appreciate. New card users receive 50,000 bonus points when you spend $1,000 within the first 3 months of opening the account. You can earn 5 points per dollar spent on Marriott property stays, 2 points per dollar spent on airline tickets, car rentals, and purchases made at airports, and 1 point for all other purchases.

Further, if you plan to travel overseas, you're in luck — there are no foreign transaction fees with this card. There is an $85 annual card membership fee, which is waived during the first year of card membership. As you can see, this metal credit card is a great choice if you frequently travel and if you regularly stay at Marriott properties.

| regular APR | |

- 3x points on purchases in travel and dining categories

- 1x regular rewards rate

- 100,000 points intro rewards for spending $4,000 in the first three months of the account. That's $1,500 to spend towards travel if you purchase through Chase Ultimate Rewards®

- $300 annual travel credit

- $100 credit towards Global Entry or TSA Pre-Check purchase.

$450 annual fee

$300 annual travel credit

$100 credit on Global Entry/TSA Pre-Check

50,000 intro bonus for spending $4,000 in the first 3 months.

50% bonus on redeeming through Chase Ultimate Rewards®

The newest addition to the Chase Sapphire collection is the Chase Sapphire Reserve card. You can earn 3 points per dollar on every travel and restaurant purchase. All other purchases earn 1 point each. If you spend $4,000 within 3 months, you can earn 50,000 bonus points. The card also comes with a yearly $300 travel credit, a $100 credit, which can be used for Global Entry or TSA Pre-Check, and a yearly Priority Pass membership, which offers access to airport lounges all around the world. This card has a $450 annual fee.

JP Morgan Chase Palladium Card

If you’re interested in carrying a truly high-end elite card, you should consider the JP Morgan Chase Palladium Card. This card is not just a metal card; it is made of palladium and 24-karat gold. This card provides United Club and Priority Pass Select membership as well as a yearly spending bonus. If you spend $100,000 on the card annually, you get 35,000 Chase Ultimate Rewards points, which can be worth as much as $735. It also includes a $100 Global Entry Fee waiver. This card has a $595 annual fee.

$450 annual fee

$300 annual travel credit

5x on Ritz Carlton and SPG purchases

special hotel privileges

The Chase Ritz Carlton Rewards card is yet another metal card made for individuals who love travel. This card currently offers a free 2-night stay at Ritz Carlton properties when you spend $4,000 within the first 3 months of card membership. You also earn 10,000 bonus points when you add an authorized user to the card and make a purchase within 3 months.

Card users can earn 5 Points for every dollar spent at Ritz Carlton and SPG properties and 2 points for every dollar spent on restaurant purchases and direct purchases made through an airline or car rental company. All other purchases earn 1 point per dollar spent. The Ritz Carlton Rewards card also offers a $300 annual travel credit as well as a yearly Priority Pass membership – which makes waiting at the airport a breeze. There are no foreign transaction fees. The Ritz Carlton Reward card carries a $450 yearly fee.

$95 annual fee, waived for the first year

first checked bag free

30,000 miles intro bonus

Fans of United Airlines will want to check out the Chase United MileagePlus Club Card. This card offers valuable benefits including a 50% mileage bonus, United Club membership, Premier Access Priority airport services, checked bag fee waivers, and waived award travel fees. You also earn 2 miles per dollar spent on purchases from United and 1.4 miles per dollar spent on all other purchases. The annual fee is $395.

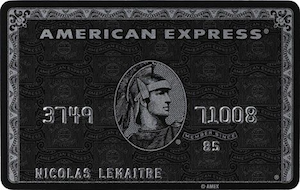

Amex Centurion

This card is considered one of the most exclusive cards available. The American Express Centurion is invitation-only, which means you won’t be able to apply for the card until Amex invites you. There is an invitation fee of $7,500 and an annual fee of $2,500 — one of the highest annual fees you’ll find with any credit card. It is reportedly made of titanium, which adds to the feel of exclusivity and prestige.

This card comes with many benefits. Some of the perks include Starwood Preferred Guest Gold, Hilton HHonors Diamond, access to the Centurion Hotel Program, airline statuses such as Delta SkyMiles Platinum Medallion, Centurion airport lounge access, and a 30% airline bonus on Membership Rewards points. You also get valuable benefits such as a $200 airline free credit and access to Centurion Dining Program.

MasterCard Black, MasterCard Gold, MasterCard Titanium

A line of three types of metal credit cards, the MasterCard Black, MasterCard Gold, MasterCard Titanium. Each card offers different features.

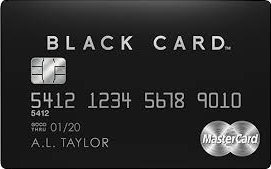

MasterCard Black Card

MasterCard Black Card has an annual fee of $495 and is made of stainless steel and carbon. It offers you one point for each dollar you spend, with points being worth three cents each if you redeem for airfare. There is a 0% intro APR for 15 billing cycles for balance transfers posted within the first 45 days of account opening. Card benefits include a $100 annual credit toward airline purchases, a $100 credit for the Global Entry application fee, airport Lounge Club access, and many others.

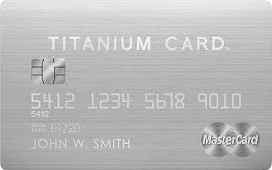

MasterCard Titanium Card

MasterCard Titanium Card has an annual fee of $195 also made of stainless steel and carbon. You can earn one point for each dollar you spend with the card, which are worth 2 cents each when you redeem them for airfare. If you redeem them for cash back, each point is only worth 1 cent each. This card includes a 0% intro APR for the first 15 billing cycles for balance transfers posted within the first 45 days of opening your account. This card comes with benefits such as airport escort, chauffeured transportation, complimentary room upgrades, and many others.

MasterCard Gold Card

MasterCard Gold Card has the highest annual fee of the three cards at $995 and is 24-karat gold-plated on the front and carbon on the back. You get one point for each dollar you spend with points being worth about four cents apiece when you redeem for airfare. This card also comes with benefits such as a $200 annual credit toward airline purchases, a $100 credit for your Global Entry application fee, Lounge Club access, chartered services by jet or yacht, and room upgrades.

Are the Benefits Worth the Annual Fee?

While most people carry these types of cards simply because of the look and feel they give as prestigious credit cards, there are usually a number of other reasons you might want to consider carrying one. For instance, many offer travel rewards and perks which can be worth hundreds or even thousands of dollars if you frequently travel. Some of these valuable benefits include the following:

- Lounge Club Access

- Global Entry/ TSA PreCheck Reimbursement

- Annual Travel Credits

- Complimentary companion Tickets

- Free airfare or hotel stays

- Concierge services

As you can guess, each one of these benefits can be worth hundreds of dollars by themselves. Many of these metal credit cards include all these perks plus many others. Whether these cards are worth the annual fee is dependent on the types of purchase you make with the card and whether or not you can use the features offered.

What Makes a Metal Credit Card Different?

You might be wondering what the difference is between metal credit cards and the typical plastic credit cards. The biggest difference is that metal cards are generally embedded with actual metal, which makes them feel a bit heavier and thicker than other credit cards. They typically have a much sleeker look and, for some, seem a bit more prestigious.

How Do Metal Credit Cards Work with Airport Security?

Because these cards are embedded with metal, you might be wondering how that works when you try to get through airport security. If you want to carry your metal card when you travel, you should be prepared to get stopped by the Transportation Security Administration (TSA). Any amount of metal in the card will most likely set off the metal detectors. You can usually just place your cards in the same tray that you usually leave your keys and other metals in when they go through the conveyor belt.

Any Problems with Credit Card Readers or Mobile Credit Card Readers?

With many retailers in the US currently transitioning to chip card readers, you could also encounter problems when you use a metal card with a credit card reader or mobile credit card reader. Although you might have problems with certain card scanners simply because metal cards are thicker and heavier, other credit card readers and mobile credit card readers shouldn’t have a problem reading your card.

No matter which type of credit card you choose, it’s important to make smart purchase decisions. Always make sure that you fully understand the terms and benefits of your card to avoid extra fees. Luckily, there are many benefits that make these cards worth it.

Conclusion

When choosing between various metal credit cards, it’s best to consider your regular spending habits as well as the perks that are most important to you. You can continue to travel and use your card without changing your spending, while taking advantage of extra benefits that will make your overall experience even better.

Leave a comment

CREDIT SCORE UPDATES

exclusive members-only deals