What are the Most Exclusive Credit Cards?

If you have a high net worth and a great credit score, you can take advantage of better credit cards that other people usually won’t qualify for. After all, don’t you deserve extra perks and benefits for successfully managing your finances and working hard to maintain your excellent credit? Fortunately, there are a number of prestigious credit cards that are specifically designed for you. Although these exclusive credit cards typically carry higher annual fees, they also provide card perks that are worth hundreds and sometimes, thousands of dollars.

At the same time, these cards also carry very stringent requirements to qualify.

If you meet those requirements and you’re looking for a card that rewards you for your solid credit history, you might want to consider stepping up to one of these exclusive credit cards.

Most Prestigious Credit Cards

Some of the most prestigious credit cards are often carried by celebrities and well-known figures like the President of the United States. These cards include the following:

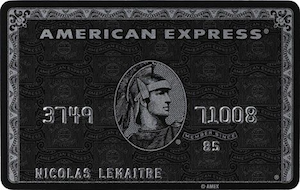

American Express Centurion Black Card

This card is often considered one of the most prestigious and most exclusive. In fact, you can’t just apply for the American Express Centurion Black Card -- you have to be invited to apply by Amex. It also comes with pretty high fees including an invitation fee of $7,500 and an annual fee of $2,500. In exchange, you get a long list of benefits including access to the Centurion Hotel Program and the Centurion Dining Program, as well as elite airline and hotel statuses. You also get Centurion airport lounge access and a 30% airline boost to your Membership Rewards points.

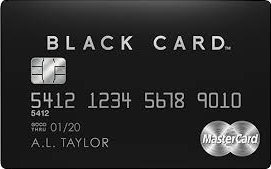

MasterCard Black Card

This card was once known as the Visa Black card and has been rebranded as the MasterCard Black Card. The cards and features are similar, except for the name change. This is one of the cards included in prestigious line of credit cards. It is made of stainless steel and carbon and awards a point for each dollar you spend with the card. It also comes with benefits such as a $100 annual credit toward airline purchases, a $100 credit for the Global Entry application fee, and airport lounge access. The annual fee is $495.

MasterCard Gold Card

Another exclusive card is the MasterCard Gold Card. This card is 24-karat gold-plated on the front with a carbon backing.

You get one point for each dollar you spend, but unlike the other cards, each point is worth as much as four cents per point when you redeem them for travel. It also includes benefits like a $200 annual credit toward airline purchases, a $100 credit for your Global Entry application fee, and Lounge Club access. This card has the highest annual fee of the three at $995.

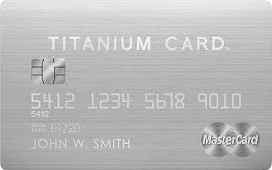

MasterCard Titanium Card

Of the three exclusive cards above, the MasterCard Titanium Card has the lowest annual fee of $195. Like the other two cards, this card awards a point for each dollar you spend with the card, but points are only worth 2 cents each when you redeem for airfare. It also includes benefits such as airport escort, chauffeured transportation, and complimentary room upgrades.

JP Morgan Visa Infinite (JPMorgan Chase Palladium)

This card is also considered an elite card. The JP Morgan Visa Infinite or JPMorgan Chase Palladium is made of palladium and 24-karat gold.

Benefits include United Club and Priority Pass Select membership and, if you spend $100,000 on the card annually, you get 35,000 Chase Ultimate Rewards points, which can be worth as much as $735. It also includes a $100 Global Entry Fee waiver. The annual fee for this card is $595.

Other Super Luxury Cards

There are other super luxury cards that aren’t as well-known or as popular. If you’re looking for an elite type of card, you might also want to consider these.

Accolades Credit Card

For this card, you have to have at least $200,000 in assets with a Merrill Lynch investment firm. In comparison to other luxury cards, the annual fee is fairly affordable, at $295. Plus, this fee can be waived if you have high asset amounts at any Bank of America Asset Management division. The Merrill American Express Accolades Credit Card includes benefits like luxury vacations, Priority Pass airport lounge membership, and 24-hour concierge. Another feature to note is that the card has a credit limit of $500,000, which is unusual among exclusive credit cards.

$450 annual fee

$300 annual travel credit

5x on Ritz Carlton and SPG purchases

special hotel privileges

If you frequently stay in Ritz-Carlton properties, you should check out the Chase Ritz Carlton Rewards card. New cardholders can earn a free 2-night stay at Ritz Carlton properties when you spend $4,000 within the first 3 months of card membership. The card also provides 10,000 bonus points when you add an authorized user to the card and make a purchase within 3 months.

You also earn 5 Points for every dollar spent at Ritz Carlton and SPG properties and 2 points for every dollar spent on restaurant purchases and direct purchases made through an airline or car rental company. Other benefits include a $300 annual travel credit as well as a yearly Priority Pass membership. This card has an annual fee of $450.

$95 annual fee, waived for the first year

first checked bag free

30,000 miles intro bonus

The Chase United MileagePlus Club Card offers benefits such as a 50% mileage bonus, United Club membership, Premier Access Priority airport services, and checked bag fee waivers. You also earn 2 miles per dollar spent on purchases from United and 1.4 miles per dollar spent on all other purchases. The annual fee is $395.

Who Can Qualify for Elite Credit Cards?

Most elite credit cards require excellent credit scores, as well as a certain amount of verifiable income. Although some issuers, such as American Express, won’t share the criteria for cards like the Centurion black card, it’s pretty clear that you have to meet a certain income threshold to get an invitation.

For most of the elite cards, you will need a credit score in the high 700s or over 800, as well as an annual income at least at $100,000 per year

With many luxury credit cards, you will need an even higher credit score and annual income, as well as proof that you plan to spend big and carry a balance. Some cards, however, are easier to qualify for than others.

Credit Limits on Premium Credit Cards

Typically, there are no credit limits on premium credit cards, leaving the cardholder with the flexibility to make large purchases without worry. These cards are usually more like charge cards with open credit lines, except you don’t have to pay your balance in full each month. One of the exceptions to the open line of credit is the Accolades card, which is known to carry a spending limit of half a million dollars. Although it’s a cap on your spending, it’s high enough that most people won’t mind.

Benefits of Exclusive Credit Cards

Besides the prestige that comes with just carrying an exclusive credit card, many people count the benefits as well worth the costs. The value of these cards is based on whether or not you travel frequently or can take advantage of the wealth of benefits these cards offer.

Some of the benefits that come with most of these cards include the following:

- Concierge services: This benefit provides assistance when you have questions or need help booking travel plans.

- Lounge Club Access: This makes traveling more comfortable and with airport lounge club access costing hundreds of dollars per year, basically pays for your annual fee.

- Global Entry/ TSA PreCheck Reimbursement: This is usually worth $100 every five years and lets you skip waiting in long lines at the airport.

- Free airfare or hotel stays: Because these are exclusive cards, the free airfare or hotel stays are typically at the same level, which are worth hundreds of dollars apiece.

- Annual Travel Credits: The annual travel credits are usually at least $200, which can pay for many different types of travel expenses, depending on the credit card.

To make these types of cards even more valuable, most carry more than one or all of these benefits.

Although the annual fees are typically higher than most, it’s easy to see how the card could end up paying for itself just through its extra perks and benefits.

Premium Credit Cards for Everyone

Although you do have to have a good credit score and high income to qualify for exclusive credit cards, there are premium credit cards that come with just as many perks and are considered just as prestigious. These cards, however, are intended for those of us who might not be celebrities, but still want to take advantage of the benefits of carrying a premium credit card. Some of these cards include the top-tier credit cards such as the following:

$85 annual fee, waived for the first year

80,000 sign up bonus

5x points on Marriott

2x points on airlines, rental cars, dining out

The Marriott Rewards Premier card is way more than just a hotel rewards credit card. It is considered a luxury card that is often easier to attain than some of the others. It comes with a sign-up bonus of 50,000 bonus points when you spend $1,000 within the first 3 months of opening the account. It also awards 5 points per dollar spent on Marriott property stays, 2 points per dollar spent on airline tickets, car rentals, and purchases made at airports, and 1 point for all other purchases. The annual fee is $85, but it’s waived the first year you are a cardmember.

| regular APR | |

- 3x points on purchases in travel and dining categories

- 1x regular rewards rate

- 100,000 points intro rewards for spending $4,000 in the first three months of the account. That's $1,500 to spend towards travel if you purchase through Chase Ultimate Rewards®

- $300 annual travel credit

- $100 credit towards Global Entry or TSA Pre-Check purchase.

$450 annual fee

$300 annual travel credit

$100 credit on Global Entry/TSA Pre-Check

50,000 intro bonus for spending $4,000 in the first 3 months.

50% bonus on redeeming through Chase Ultimate Rewards®

The Chase Sapphire Reserve card is a new luxury card offered by Chase. It awards 3 points per dollar on travel and restaurant purchases and 1 point for all other purchases. You can earn a bonus of 50,000 points if you spend $4,000 within 3 months. Other benefits include a yearly $300 travel credit, a $100 credit for Global Entry or TSA Pre-Check, and a yearly Priority Pass membership, which offers access to airport lounges all around the world. The annual fee is $450.

Platinum Card® from American Express

This is one of Amex’s most well-known cards. The Platinum Card® from American Express is a charge card rather than a credit card, which requires payment of the entire balance in full each month. You can earn 5X points for flights booked with airlines or American Express Travel and one point for each dollar you spend on other purchases. The annual fee is $550. New cardholders can earn a bonus of 60,000 points after you use your card to make $5,000 in purchases within the first 3 months. Other benefits include Hilton Honors Gold Status, a $200 airline fee credit, and a statement credit you can use toward Global Entry or TSA PreCheck, and airport lounge access. The annual fee is $550.

$450 annual fee

50,000 miles welcome bonus

2x miles on American Airlines and US Airways purchases

Admirals Club membership and airline benefits

This card awards two miles for every dollar you spend with American Airlines and one mile for each dollar spent on other purchases. New cardholders can earn a bonus of 50,000 miles after you spend $5,000 within the first 3 months. Other card benefits include Admirals Club membership, an annual miles bonus of 10,000 AAdantage Elite Qualifying Miles if you spend $40,000 on purchases within the year, and free checked bags. The annual fee is $450.

Leave a comment

CREDIT SCORE UPDATES

exclusive members-only deals