Metromile Offers Pay-Per-Mile Auto Insurance

Several of my friends own cars but don’t use them to commute to work. Instead, they walk, bike, and take public transportation. They enjoy being able to drive to the grocery store or take weekend trips, but the cars sometimes stay parked and untouched throughout the week. When Metromile launched its pay-per-mile auto insurance in our area, they looked into the coverage and decided to switch because it would save them hundreds of dollars a year.

Partially because of my friends’ experiences, I was intrigued to learn more about Metromile. I reached out to the company and asked about its history, auto insurance product, and plans for the future.

Louis DeNicola: What is Metromile and how did the company start?

Dan Preston: Metromile offers pay-per-mile car insurance. This means that unlike traditional car insurance companies who charge a flat rate, Metromile insurance is based off of the miles you drive.

Metromile was founded in 2011, but the idea of pay-per-mile car insurance isn’t a new one — in fact, the concept has been around for nearly 100 years, but the technology to get an accurate read on mileage did not exist and was not affordable until recently.

Traditional car insurance is unfair to low-mileage drivers. In fact, 65 percent of drivers overpay to subsidize high-mileage drivers.

The number one risk indicator for drivers is how often they’re on the road, so drivers that drive less really should pay less for car insurance

Quite simply, Metromile’s pay-per-mile insurance costs less because it’s based on how many miles you drive.

Our customers pay a low monthly base rate, plus a few cents per mile and save an average of $500 per year.

Does Metromile insurance provide the same protection as "standard" auto insurance?

Yes, we offer four different levels of liability protection as well as choices for your comprehensive and collision deductibles. We also offer roadside assistance as an optional add-on, insurance for multiple vehicles, and most policy coverages are still in effect if you’re using a rental car.

Who's eligible to use Metromile?

Anyone that drives 10,000 miles or less will most likely see savings with Metromile pay-per-mile insurance

In order to log the miles a customer drives, a small device must be plugged into the vehicle’s OBD-II port, which did not become a standard requirement in vehicles until 1996. If your vehicle is older than that, it may not be compatible.

Currently, per-mile insurance is available in California, Illinois, New Jersey, Oregon, Pennsylvania, Virginia, and Washington.

Who might save money by switching to Metromile?

Anyone that drives 10,000 miles or less will most likely see savings with Metromile pay-per-mile insurance. On average, our customers save an average of $500 per year!

Do you offer drivers any discounts?

Customers can add multiple vehicles while completing a quote online. Our multi-car discount will save customers money on each vehicle’s base rate and per-mile rate.

Daily mileage charges are capped at 150 miles per day for each vehicle (250 miles per day in WA), so customers are not charged for miles above those amounts in any calendar day

If you don’t drive any miles in a given month, you’ll only be charged the base rate for that month, and you will never be penalized or have your rate increase purely because of an increase in annual miles.

What does the Metromile Pulse device do?

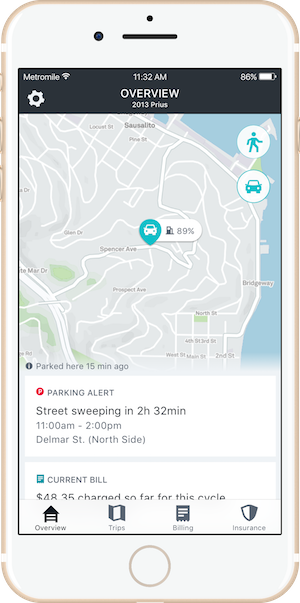

The Metromile Pulse device is an OBD-II sensor that measures mileage. Metromile also offers a smart-driving app that works with the Metromile Pulse and gives drivers visibility into their cars’ general health and usage while also providing timely and actionable insights.

The Metromile Pulse device is an OBD-II sensor that measures mileage. Metromile also offers a smart-driving app that works with the Metromile Pulse and gives drivers visibility into their cars’ general health and usage while also providing timely and actionable insights.

The app includes features such as trip summaries, driving trends, street sweeping alerts in select markets, car health, car location, etc.

Customers always have the option to turn GPS off as well.

Are there any new features you're planning to add to the Pulse?

In the last year, Metromile acquired an insurance carrier to officially hold risk and handle claims. We want to deliver a vastly new experience on the claims front, taking learnings from customer experience, and we are focused on providing customers a faster, more fair, and seamless claims experience within the Metromile app.

How do you keep drivers' private information (e.g. GPS data) secure?

We take your privacy very seriously, including protecting your location information. You can review our privacy policy for more information.

Do you see Metromile expanding and offering different types of insurance?

At the moment we’re focused on our pay-per-mile car insurance product and improving the claims experience. Last year, we partnered with CoverHound, an online insurance comparison shopping platform to provide coverage options for customers. This will make it easier for pay-per-mile insurance consumers to purchase the right homeowners, renters, motorcycle, and other property and casualty insurance.

Heres a video by Metromile, explaining how pay per mile insuance works.

Leave a comment

CREDIT SCORE UPDATES

exclusive members-only deals