What Is FINRA and How Does It Help Individual Investors?

The Financial Industry Regulatory Authority (FINRA) is one of the most important financial regulatory organizations in the United States. It is a private organization made up of securities firms that’s tasked with creating, and enforcing, regulations that protect investors.

We recently had a chance to speak with Gerri Walsh, the senior vice president of Investor Education at FINRA and president of the FINRA Investor Education Foundation, about the organization and how it helps benefits individual investors.

Louis DeNicola: What is FINRA? When and why was it created?

Gerri Walsh: FINRA is a non-profit, non-governmental regulator of the securities industry. What that means in plain language is any person or firm that sells stocks, bonds, mutual funds, variable annuities or anything that's considered a security under the federal securities laws has to be registered with FINRA. We oversee the people and organizations that sell those products.

Back when the financial crisis of 1929 happened, the big stock market crash, Congress started taking action to create the Securities and Exchange Commission (SEC). It started with the Federal Securities Act of 1933, and then the Securities Exchange Act of 1934.

In 1939, there were some amendments to the Securities Exchange Act that provided for this concept of self-regulation by the securities industry. It created this category called national securities associations. For a long time, FINRA's predecessor, the National Association of Securities Dealers, Inc. (NASD), was one of the only national securities associations that was registered with the SEC.

While we're not the government, we are empowered by Congress to do what we do and we are overseen by the SEC. Just as we regulate brokerage firms and individual brokers, we are ourselves regulated by the SEC.

Not a single dime of taxpayer dollars funds our operation. Instead, our operations are funded by the brokerage firms we oversee. We charge assessments, so it's a very efficient model of regulation.

If your funding comes from the organizations that you regulate, how do you manage that potential conflict of interest?

It's similar to the Federal Deposit Insurance Corporation (FDIC). That organization doesn't get funding from Congress, instead they levy assessments on the banks that they regulate. It's an important question about conflicts of interest, though. That's why FINRA is governed by a majority public board, because we take the potential for conflicts of interest very seriously.

The assessments are levied in a way that they're shared proportionately to the size of the firm and to the amount of transactional business that the firm engages in. The assessments are also just one mechanism for funding. Another mechanism does come from fines that we impose. However, while we assume that there'll be an amount, we don't budget for fines.

What authority does FINRA have to create or enforce regulations?

We oversee the brokerage industry. The authority comes from the amendments to the Securities Exchange Act, and by virtue of our being registered with the SEC as a national securities association.

We write the rules that brokers and broker dealers, the firms, have to abide by. Then we enforce those rules, the rules the SEC has written related to the brokerage industry, and also the municipal securities rulemaking board.

How does FINRA help protect individual investors?

Our mission is investor protection and market integrity, and we take that mission very seriously. With respect to investor protection, we write the rules that brokers and broker dealers have to abide by and then we enforce those rules.

We do that through a variety of mechanisms. We do periodic examinations of brokerage firms to ascertain whether the firms are adhering to our rules, the SEC's rules and if appropriate, the rules of the municipal securities rulemaking board.

When they're not, we work with the firm either to take corrective action, we might provide a deficiency letter that gives them areas where they need to improve their operations, or we may take enforcement action against them.

We really feel like we can be on the front line to help investors by virtue of making sure that the brokerage component of the securities industry operates fairly.

How can someone file a complaint about a broker, or warn you if they see something that doesn’t seem right?

You can go to FINRA.org/complaint. We also have a helpline that we set up for individuals to call if they have questions. Perhaps they're uncertain about something their broker has done, they have questions about their account statements, or they don't understand something, they can call the securities helpline toll free at 844-57-HELPS (844-574-3577).

Does FINRA offer any educational or research tools to individual investors?

FINRA believes that an educated investor is the best form of investor protection. In so many ways, it's the best defense against problems.

We have a robust website, FINRA.org/investors, that has a number of materials. They can help you think about your financial goals, look at your financial circumstances, and see what can you do to help get out of debt and to build emergency savings. And to build savings that you can invest in the markets.

There’s a lot of information about investing, such as key principles of investing, knowing yourself as an investor, thinking about your goals, matching investments to those goals, understanding how those investments work, focusing on fees and costs, and what help you get from the brokerage industry. We also have some more advanced concepts for individuals, such as day trading and day trading on margin.

Then we have some really great tools that investors can use. They're all free, and none of them are geared to selling a product.

As a regulator, we can't endorse any particular product, professional or strategy. What we can do is give you the tools and information you need to make a sound investment decision.

What are a few of your favorite resources or tools?

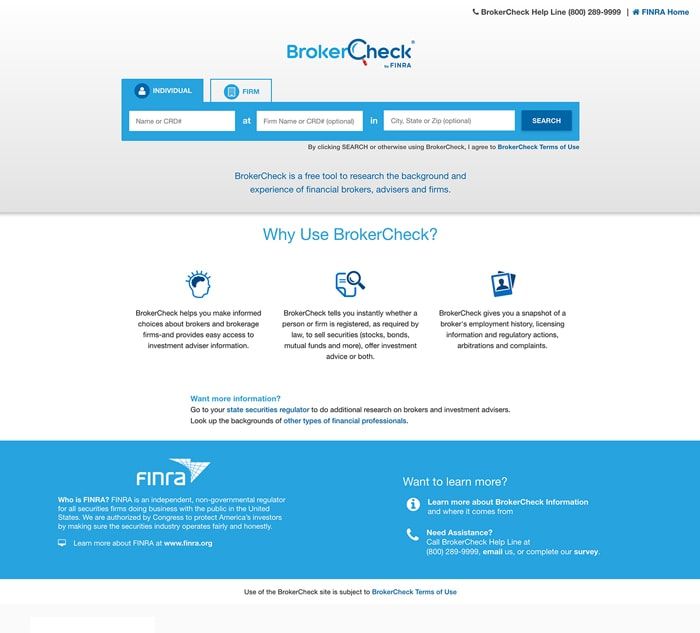

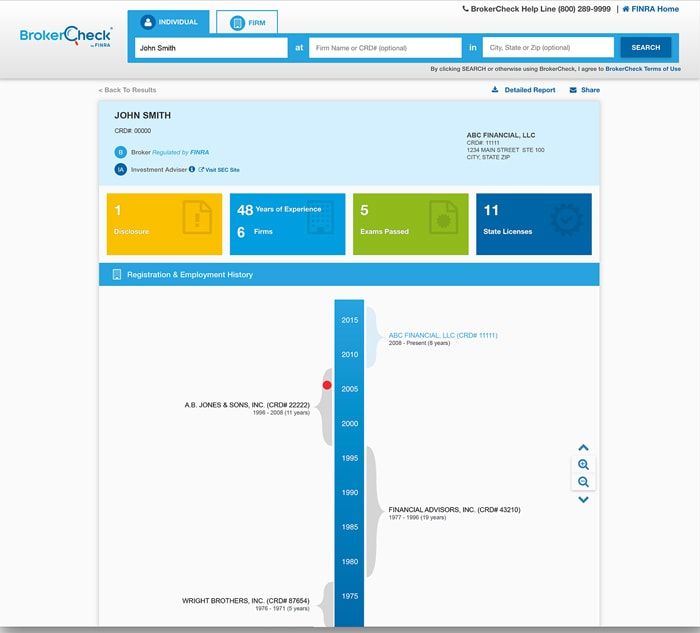

The first tool that every investor should use is Broker Check. Broker Check is a free tool that allows you to check an individual or a firm is registered with FINRA and to see their background and disciplinary history.

Most brokers have no disciplinary history, but you can find out how long they've been in the business, what firms they've worked for, and learn more about who they are. You can get detailed information or you can get a summary page. It's a fabulous resource that we really encourage investors to use.

We all check reviews before going out to dinner or making a large purchase. When it comes to investing your money and using a financial professional to provide guidance, too few Americans use Broker Check. It's free and easy and there's no reason not to check.

Another tool that's a really great is the fund analyzer. It’s a data-fed tool that takes information from prospectuses, mutual funds, exchange-traded funds, and exchange-traded notes, and presents it in a way that you can compare funds and see the impact of costs over time.

There are thousands and thousands of mutual funds out there, and the tool can help you see which is the one that's right for you. You can also clearly see the impact of fees, and the risk factors of a particular fund. It's a great way to both look for and compare mutual funds.

What do you think were some of the most important findings from FINRA’s 2016 National Financial Capability Study?

There have been three waves of the study so far. In 2009, 2012, and 2015 we collected data from more than 25,000 U.S. adults. It's a very robust and rich set of data that show us not only the knowledge that American financial consumers have, but also their attitudes and behaviors.

We have a couple of measures of financial capability that we focus on, including whether people are making ends meet, whether they're planning ahead, how they're managing financial products, and their financial knowledge.

We asked some new questions about medical debt in this particular wave.

We found that more than one in five Americans have some form of unpaid medical debt.

While that's lower than the amount that we saw in 2012, there were some interesting findings. Women, in particular, were more likely than men to have put off medical services because of the cost of those services, which is a little bit frightening.

One of the other things that we looked at too is a concept called financial fragility. The idea is, how readily could you come up with $2,000 in a month's time if there was an unexpected emergency?

What we found is that Americans are extraordinarily financially fragile. Overall, 34 percent of the adults that we surveyed said that they probably or they certainly could not come up with $2,000.

That means people don't have precautionary savings, it means that they likely have to resort to credit cards or even higher-interest-alternative-lending systems, like a pay day loan or an auto title loan, to weather financial shocks.

There were a couple of groups in particular that were financially fragile. Young people aged 18-34, 43% of that population within our sample said that they could not come up with $2000, probably or certainly could not come up with $2000. Not surprisingly, people at the lower end of the income scale were fairly financially fragile. We also saw a lot of financial fragility among African America respondents and Hispanic respondents, and also among those who had less than a college degree.

We ask some attitudinal questions, including whether you feel like you have too much debt. Four in 10 Americans either strongly or substantially agreed that they've got too much debt right now. That hasn't changed very much since we first asked that question in 2012.

There was a drop in financial literacy since the 2009 wave. If this is a trend, how can we reverse it?

Literary tends to be correlated with better financial behaviors, but we can’t tell whether there's a causal effect. In other words, if you raise financial literacy levels, do you see better behavior? But because we see this correlation, it seems important to build financial capability.

Financial capability isn't just about knowledge, it's important that behaviors eventually change. That's where we need to devote resources. Both to understand what are the behaviors that seem to be correlated with low levels of financial literacy, and how can we target those populations with messaging or strategies that allow them to become more financially capable.

As regulators, we're not able to develop financial products, but other organizations are innovating financial products. The FINRA Foundation, for example, has had an opportunity to work with non-profits that are piloting small dollar loans that are offered through an employer. It has a savings component, credit-building component, and could be a great way to improve people's financial circumstances.

We all need to work together, consumers, the financial industry, regulators, and other policy makers, to raise awareness about the importance of understanding basic money management.

Ultimately, money is emotional. People often make decisions using the non-rational side of their brain. If we're able to get people to understand how money works in a non-emotional context, hopefully that will help. But if you're thinking about what you want to buy and you're thinking about what future you want for your child, that tends to be very emotional and we sometimes overextend ourselves.

Leave a comment

CREDIT SCORE UPDATES

exclusive members-only deals